Certain trends in the containerboard space, like price increases, are expected to carry their influence into 2025. But other topics, like new tariff threats, also are entering the mix as contenders for top attention in the new year, analysts say.

RaboResearch recently released its quarterly North America containerboard report for Q4 2024, which projects an 11.4% annual price increase through September 2026. This “closely aligns” with the average $60-80 per metric ton price increase announcements for various grades of containerboard in 2025.

"The $70 price hike, it's quite large, and partially because of some of the previous hikes not being recognized," said Xinnan Li, packaging and logistics analyst at RaboResearch.

Last month, Packaging Corporation of America became the first major fiber board producer to announce these 2025 increases. Soon after, International Paper, Georgia-Pacific, Smurfit Westrock, Pratt Industries and Cascades followed with various hikes, and Greif joined the mix this month.

Also in December, at least five domestic producers of uncoated freesheet — Domtar, PCA, Phoenix Paper, Sustana and Sylvamo — announced January increases of about 5-10%, according to market analysts.

Many containerboard producers attempted to raise prices on various products at least twice in 2024. Some industry observers argued the economic environment, specifically lagging demand, did not support one increase this year, much less several. But subsequent attempts largely stemmed from producers trying again after leading third-party index Fastmarkets RISI indicated the market didn't recognize the full increases that producers announced.

Many observers will watch closely on the third Friday of January to see if Fastmarkets' monthly index shows price movement for companies' newly announced increases, and if so, how much.

"It's very likely that the price hike is going to be recognized. Whether it's going to be the full $70 amount is questionable, because it is quite a large hike," Li said. "But it could be $45 or $50. That's possible."

Graphic Packaging International announced during the company's most recent earnings call, on Oct. 29, that in 2025 it would depart from using third-party indexes to trigger conditions in customer contracts. The question now is whether other companies will follow.

"I think quite a few large companies have been looking at that," Li said. "I don't know if it's going to be realized in Q1 or Q2 next year, but certainly it's something that all of the large suppliers are thinking about."

Despite ongoing chatter about the price hikes, Ryan Fox, corrugated packaging market analyst at Bloomberg Intelligence, said it's important to keep in mind how little of the containerboard market the third-party indexes actually reflect.

"It's 5% or less of the total market" because it only covers the open market, which keeps shrinking, he said. "So you have to just put things in their order of magnitude and realize, are we really going to let the price of containerboard to less than 5% of the country dictate what happens to everybody?"

Demand dynamics

The price increase announcements come even though demand is flat, analysts said. But their models show some demand improvements coming down the pike.

RaboResearch's Q4 containerboard report projects that U.S. containerboard demand will expand by a 3% compound annual growth rate through September 2026, in part driven by strong e-commerce activity. The industry has been recovering from the so-called cardboard box recession for several quarters, Li said, and her model has indicated for a while that price hikes likely would occur.

"If we're looking at operating rates, we're largely back to 90% — we've been at either high 80s or low 90s for about a year or so," she said, pointing to one of the factors some companies consider to be a justification for raising prices. Other rationalizations include inflation and skyrocketing OCC prices.

"Overall, we believe the increases to be driven by increasing market demand and persistently elevated input costs," said Michael Roxland, senior paper and packaging analyst at Truist Securities, in a Nov. 29 memo to investors about the wave of price increase announcements.

Other carryover impacts

Containerboard supply is another element that analysts are eyeing for 2025. Generally, they expect production to be flat or slightly up.

RaboBank's Q4 report anticipates that containerboard production growth will be flat for two years, with linerboard production growing only 0.3% annually through the third quarter of 2026. That's actually an upward adjustment from the company's previous forecast of a supply decline.

"[W]e expect volatility in containerboard supply, with operating rates recovering in 2025 followed by a decline in 2026," the report says.

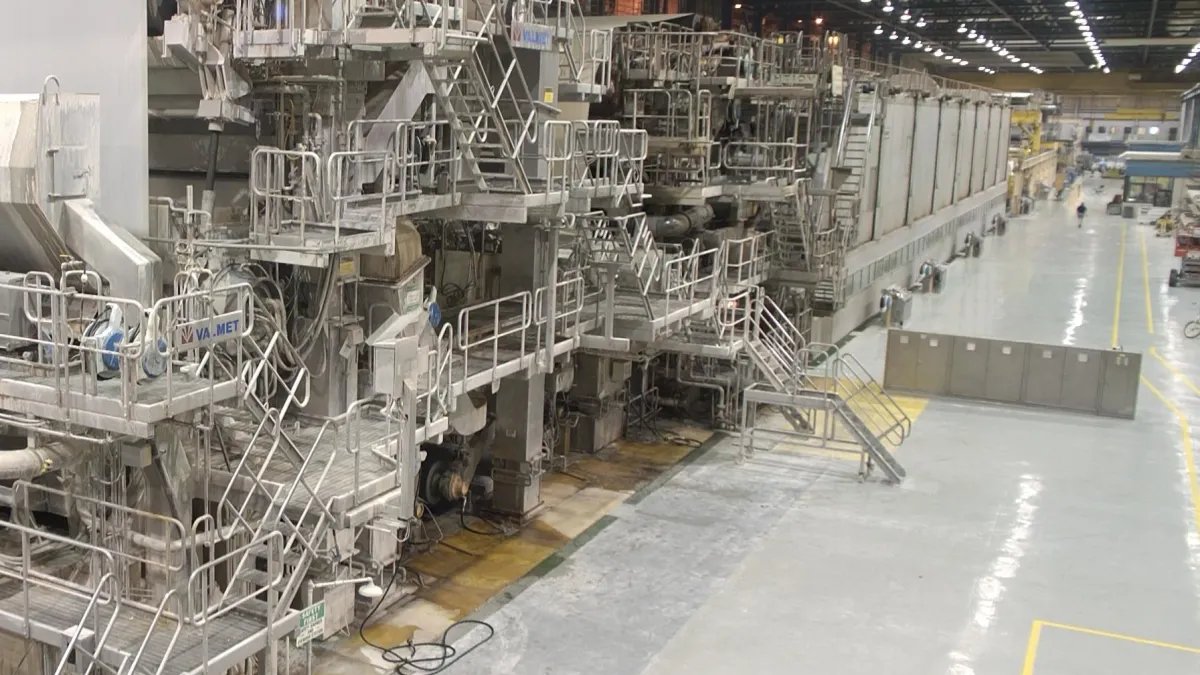

Consolidation is playing a role. RaboResearch's report says, "As the industry's megamergers play out, containerboard producers are carefully examining their operational assets and exiting those" in regions with overlap or that are lower efficiency.

Analysts' projections are for more containerboard facility downtime, idling or closures ahead.

"We do anticipate box plant closures and even the potential for mill closures. That's a very real thing," Fox said. "Volume this year is going to be roughly one-and-a-half percent higher than it was 30 years ago. So there's really not growth."

And diminishing supply typically aligns with price increases.

Tariffs in the spotlight

Containerboard pricing also is affected by inflation. With President-elect Donald Trump repeatedly expressing his intent to impose sweeping tariffs on certain countries soon after taking office in late January, many analysts expect that higher inflation is coming.

A lot of tariff discussions have centered on specific materials, such as metals, but containerboard might not be immune to the effects. Trump has expressed intent to impose universal baseline tariffs on imports, which RaboResearch says creates a heightened risk of inflation in the United States. Inflation ripples through the supply chain, and could reach fiber packaging.

"Higher inflation means slower economic activity ... and overall, a lower GDP," Li said. "So from that perspective, it's not good for containerboard demand overall."

Many of Bloomberg Intelligence's sources think it's the wrong time for increases, Fox said. But ultimately, decisions about price increases come down to whatever companies decide they want to do, he explained, whether that's justified in the eyes of the broader industry or not.

"We pay a changing price for a lot of the things that are involved in our lives every single day, and we don't scrutinize it the way some people scrutinize these commodities," Fox said. "At some point in time, the corrugated packaging industry decided that there needed to be justification to change pricing. Businesses don't owe anyone any reason why they're changing their prices.”