The American Forest & Paper Association this week released its annual industry recycling data, showing the cardboard box recycling rate bumped up to more than 93%. While many celebrated the achievement, others remain skeptical about the high figure’s validity.

AF&PA reports that the paper recycling rate in 2022 was 67.9%, a slight decrease versus last year’s 68%, with 49.1 million tons recycled. The 93.6% cardboard recycling rate in 2022 was a 2.4% increase over 2021’s 91.4%, and 34 million tons were recycled. AF&PA said OCC is the most recycled packaging material in the U.S.

“They're far and away higher rates than you see for any other major material out there and certainly at a much higher volume and economy of scale than any other material out there,” said Terry Webber, AF&PA vice president of industry affairs.

The data is coming under fire from some industry analysts who say the OCC recycling rate likely isn’t that high.

“We've seen four, soon to be five, new mills this year with 2.5 million tons of additional capacity. No bank would ever lend them money to build a 100% recycled paper mill if the recycling rate was really 93%,” said Ryan Fox, corrugated packaging market analyst at Bloomberg Intelligence. “It would be like saying you're going to compete to go after only 7% available.”

Fox teamed with Myles Cohen, founder of consulting firm Circular Ventures and former president of Pratt Recycling, to crunch separate numbers, starting with 2021 data. Last year, they presented the initial findings of their alternative methodology at a conference: They estimated the 2021 OCC recycling rate at 69%, significantly lower than AF&PA’s 91%. They offered their 2022 data to Packaging Dive, showing an estimated 67.44% OCC recycling rate, compared with AF&PA’s 93.6%.

“We have a great industry, and we have a great recycling rate. There's nothing we should be embarrassed about having a recycling rate of 67%,” Cohen said.

He and Fox call for greater transparency with AF&PA data, including how many entities are included in the survey and exactly how the equation is calculated. “It would be nice to know what they have as a numerator and what they have as a denominator,” Fox said. A key element Fox and Cohen say they include in their own methodology is an estimate of the 20-foot equivalent unit containers coming to the U.S., as they import goods in corrugated boxes.

AF&PA stands by its OCC data, which it has released annually since 1993, and Webber said the organization has “been perfectly transparent in how we do the calculation.” He said the association represents more than 90% of the industry by production capacity, and approximately 150 entities contributed their data to calculate the recycling rate. U.S. Census Bureau import and export data also gets incorporated.

This year, AF&PA also released what it calls the “effective recycling rate” in addition to the traditional rate, because some industry factors have changed over time. For example, global trade in consumer goods has increased, the original North American Free Trade Agreement took effect in the 1990s, China rose as a leading consumer goods manufacturer and the trade deficit grew over time, Webber said. AF&PA estimates the effective recycling rate to be between 80% and 85%.

“In the traditional way we think of the recycling rate, we compare recovered fiber consumption to what we call net new supply,” Webber said. “In recent years, people have been thinking of the recycling rate more in terms of generation, but that's never what the number was intended to characterize.”

The methodology for calculating the effective recycling rate removes from the denominator types of paper that simply won’t be recycled, Webber said, such as tissue paper or certain grades of construction paper. It also considers estimates of packaging bringing imported goods into the U.S. The calculation also incorporates box intensity data from the Fibre Box Association. The effective recycling rate “gives you a much clearer picture of how much additional fiber there is potentially available for recovery in a way that the traditional recycling rate doesn't,” Webber said.

Fox and Cohen agree that AF&PA’s effective recycling rate is closer to what they view as accurate, noting the importance of accounting for boxed goods imports. Still, they say the traditional rate doesn’t make sense because the way it’s calculated eventually could result in totals over 100%. That’s OK, according to AF&PA.

“I think this is where some of the confusion comes from: When you're talking about the traditional rate, you can have a recycling rate that goes over 100%. And there are different jurisdictions that report something like that,” Webber said. “How you get there is by recycling packaging that’s riding in on imported product because otherwise it kind of evades the math problem.”

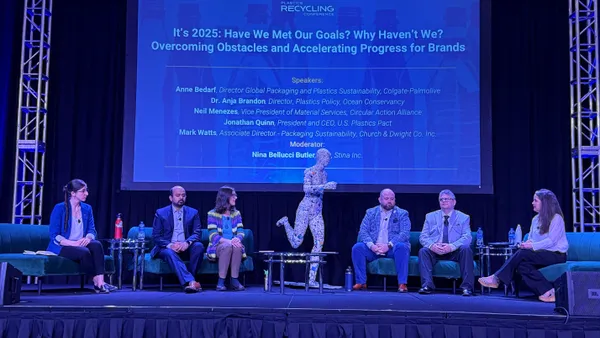

Ensuring recycling data accuracy could gain even more importance in the coming years as brands increasingly request recyclable and recycled content packaging options to meet their sustainability goals. Many report data in their annual sustainability reports to show progress on their achievements, including recycling and scope 1, 2 and 3 carbon emissions.

AF&PA acknowledges that the industry has come a long way and the recycling rate is strong, but more needs to be done to capture additional fiber from the system. Fox and Cohen agree that more work should be done, and they’d also like to change the narrative — perhaps by only referring to how many tons of OCC were recycled in a given year instead of offering a rate.

“As an industry we need to work together on the narrative and to say we have a lot more work to do in increasing the recycling rate,” Cohen said. “This kind of gives the industry an opportunity to hit the reset button and say, ‘Hey, maybe we need to think about this a little bit differently.’”