- Results: Peter Konieczny led his first earnings call Thursday since formally taking over as CEO, having previously served as interim CEO and chief commercial officer. He highlighted Amcor’s focus on orienting the packaging giant’s mix “towards faster-growing higher-margin categories,” such as healthcare, meat, pet care and premium coffee, “which we have also supplemented with value-accretive acquisitions,” he said. The first quarter of Amcor’s 2025 fiscal year ended Sept. 30. The company reaffirmed its guidance for fiscal year 2025, which will run through June 30. It expects adjusted free cash flow between $900 million and $1 billion.

- Rigids and flexibles trends: In rigid packaging, Amcor called out lower beverage volumes in North America amid ongoing soft customer and consumer demand. In flexible packaging, the company noted continued destocking in healthcare categories. But across the flexibles business, overall volumes were up about 5% year over year, with higher volumes in meat, liquid and fresh and frozen foods.

- Destocking: Customer demand is improving broadly, the company said. But the healthcare and pharmaceutical business in North America and Europe continued to face destocking trends in the recent quarter, which the company estimated as a 2% headwind to overall segment volumes. Amcor expects pharma destocking to continue in Q2. But overall, Amcor executives believe destocking will abate by the end of this calendar year.

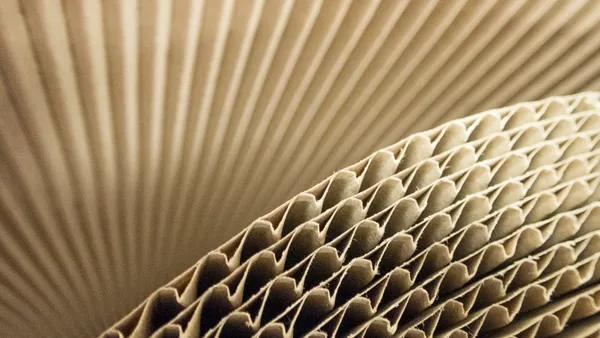

- Fiber plays: Konieczny discussed forthcoming packaging waste regulation in Europe. “It is exactly in that context that we're developing product platforms like AmFiber, like AmPrima, and others that are essentially developed in order to comply with such regulation,” he said, with recyclable and other more-sustainable attributes. Fiber-based packaging is recyclable at scale today, he noted, whereas plastic “requires more investment into infrastructure,” making fiber appealing to customers and consumers currently. However, fiber is more porous and therefore will “have a very limited range of applications across the board of what we're serving today,” Konieczny said. AmFiber means to serve as a “performance paper product, which actually differentiates us really well because we've been able to introduce barrier properties,” which are important for protective food packaging, for example.

- Restructuring update: Addressing a $170 million restructuring program the company launched more than a year ago, CFO Michael Casamento said the company is most of the way through now, and it should be wrapped up by the end of this calendar year. The company has announced seven plant closures and four plant restructures.

- Exiting closures joint venture: Amcor announced this week it entered an agreement to sell for $122 million its 50% interest in Bericap North America, a joint venture established in 1997 between Amcor Rigid Packaging and Germany-based Bericap. It manufactures closures for beverage, food and industrial end markets across three facilities in the U.S., Canada and Mexico. Its fiscal 2024 sales were about $190 million. Amcor said it does not expect the transaction will impact its fiscal 2025 financial outlook. “At this juncture, we have chosen to unwind the joint venture given differing views on near-term capital requirements and resulting returns,” Konieczny said in a statement. “While Amcor continues to operate in the closures space as it remains a category of interest, we are committed to maintaining our disciplined approach to capital allocation.”

Amcor to exit longstanding closures joint venture in $122M deal

Amcor noted the deal during its first fiscal 2025 earnings call, in which new CEO Peter Konieczny also discussed the role destocking is playing in healthcare.

Recommended Reading

- Amcor drops ‘interim’ from Peter Konieczny’s CEO title By Maria Rachal • Updated Sept. 6, 2024

- Packaging manufacturers share insights from Q3 By Packaging Dive Staff • Updated Nov. 12, 2024