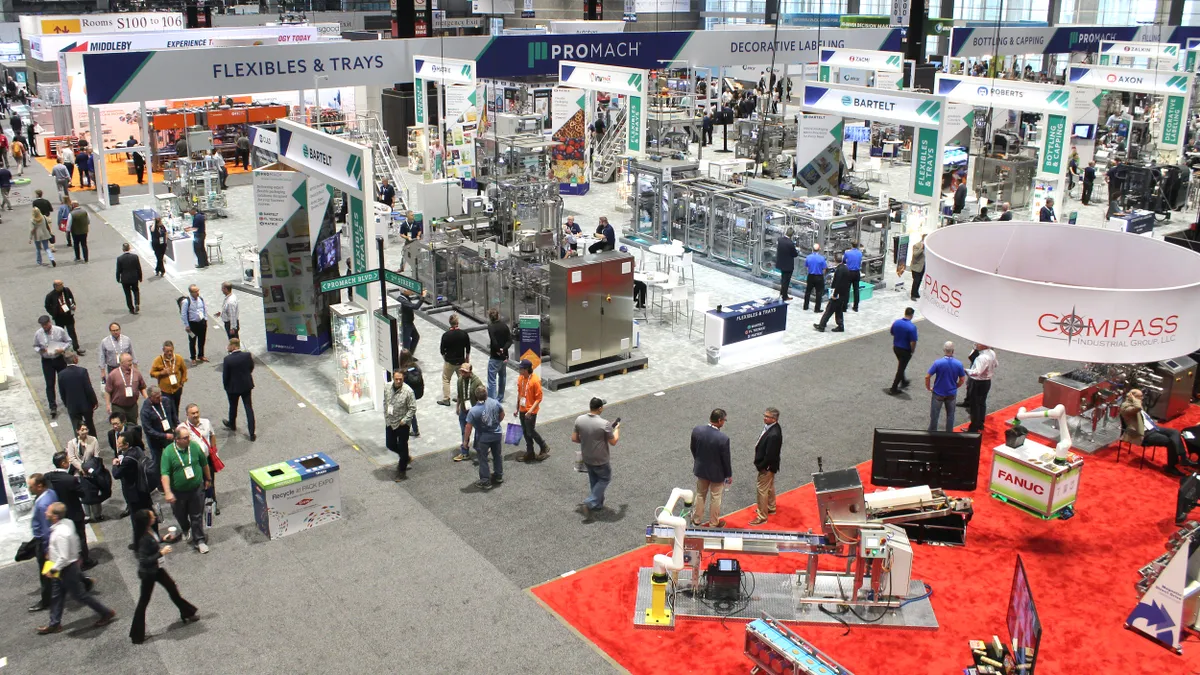

Pack Expo International wrapped up in Chicago on Wednesday, closing four days of exhibits, educational sessions and networking for those in and adjacent to the packaging and processing industries.

Approximately 48,000 attendees packed the halls at the largest ever Pack Expo event, according to host PMMI. Attendees filled spaces across all four buildings at Chicago’s expansive McCormick Place, bringing the biggest convention center in the United States its largest crowd of 2024.

Sustainability was a focal point for educational sessions as the Sustainability Central stage returned for its second year. An Emerging Brands stage also joined the six other educational session sites this year.

Sustainability and innovation were underlying themes at Pack Expo 2023 in Las Vegas that carried over to this year’s event. Other themes, like labor and automation, bumped to the top of the 2024 buzzworthy topics list.

Labor in the limelight

The packaging industry continues to grow, as has been the trend for a couple years, said Jorge Izquierdo, vice president of market development at PMMI, but labor shortages are shaping the industry and operations.

“It's harder and harder to find people, harder and harder to retain them, harder and harder to find the skills that we're looking for,” he said. “And that's created a significant amount of investment for the industry.”

Notably, investments are occurring in automation and artificial intelligence-enabled equipment. PMMI has observed “a special interest to grow quickly the use of AI to support the workforce, specifically [equipment] troubleshooting” and maintenance.

“You need to make new investments on equipment, on technology that will allow you to keep growing with the current workforce [because] there's no expectation that the workforce situation will be improving significantly in the near future,” Izquierdo said. “This equation is how ... CPGs are now justifying the investment in equipment, but taking into account the workforce.”

The main issues fall into two buckets: training for incoming employees and the tenure of existing employees. Whereas employees previously used to stay at a job for 20 years, right now “it’s more like three years,” said Izquierdo. A developing strong point is the industry’s work “to make training more efficient.”

Besides workforce changes, Izquierdo pointed to sustainability as a trend continuing to shape packaging. Packaging substrate and design changes for sustainability are rapidly increasing, as is the desire or mandate to use recycled content.

But such changes often require operational alterations or equipment retrofits for efficient performance. For example, adding recycled content to materials can reduce equipment performance. Still, the challenges are not slowing the sustainability movement, and the industry must continue to adapt to these evolutions, Izquierdo said.

Reusables gain momentum

As the Reusable Packaging Association celebrates its 25th anniversary this year, the organization’s leader described recent growth in the sector — after a slower ramp-up. It’s the “dawn of an era” for widespread acknowledgment of reuse’s role in packaging management, said RPA President and CEO Tim Debus.

“I really sense this awakening that's taking place in the markets, public policy and even with consumers that I've not seen before, even just a few years ago. ... There's clarity that's forming about reusable packaging,” he said.

The global economy’s “circularity” has dipped from 9.1% to 7.2% in the last couple years, Debus said. But that presents opportunity for reworking existing systems and incorporating more reuse solutions and infrastructure into the supply chain.

It’s “not an overnight” process and will take time, Debus said, comparing the reuse sector’s trajectory to a rollercoaster climbing an incline: “There’s a terrific downhill ride once we get to the other side.” Still, the ride will “be wild at times, because we're still figuring out reuse — especially with the consumer products and the engagement of reuse and refill with consumers,” he said.

Similarly, more businesses becoming open to trying resuable solutions presents an opportunity to rethink the legacy “reduce, reuse, recycle” hierarchy and shift a greater emphasis onto reuse, Debus said.

“Somehow we shifted that order over the last 50 years and focused a lot more on recycling than we have on the source reduction of reduce and reuse,” he said. “The waste hierarchy pyramid ... has reuse as an inner loop, a preferred activity, whereas recycling is an outer loop, last resort activity. We really need to tip the scales more to reuse in infrastructures.”

RPA believes four “megatrends” collectively will shape the reusable packaging space and accelerate growth: metrics, public policy, technology and automation.

The industry fits well into the trend of using greater digitization and artificial intelligence, Debus said: “I see reusable packaging as a tremendous opportunity to digitize the economy, digitize the supply chain,” including through adding traceability by embedding RFID chips and other devices. Digitization also makes it easier to track metrics, which will become more important as states implement extended producer responsibility for packaging laws.

The handling of reusable packaging — especially transportation-centric solutions such as pallets, crates and totes — is also ripe for further automation. That also relates back to filling labor voids.

“The workforce is declining in terms of number of participants,” Debus said. “The fact is that automation is going to be able to assist with that and able to meet the growth demands, while also [being] more efficient in many capacities.”

Flexibles flex their muscle

Significant floor space in the expo halls was devoted to flexible packaging solutions. That sector is getting increased attention in the overall packaging marketplace.

During his first week on the job as the Flexible Packaging Association’s president and CEO, Dan Felton dug into data showing the U.S. flexibles sector’s growth. As of 2023, flexibles comprised 20.4%, about $42.9 billion, of the total U.S. packaging market, creeping up on corrugated’s long-held lead spot at 21.9%. Food remained the dominant end-use market, at 46.3%, followed by medical and pharma at 14.1% and industrial at 9.4%.

Similar to other sectors, flexible packaging is evolving to meet sustainability demands. While more than three-quarters of respondents to FPA’s 2024 state of the industry survey reported using PCR, respondents believe the importance of incorporating PCR for sustainability will further escalate in the next three years. Compostables are another area expected to jump in importance, with use projected to increase from the current 56%.

Despite the market growth, flexibles still face sustainability hurdles, namely challenges with recyclability. For one, U.S. consumers generally lack access to curbside collection of flexibles, and certain store drop-off programs are in jeopardy. The industry needs more scalable solutions for collecting, sorting and reprocessing flexibles, Felton said, especially as EPR laws come down the pike and stand to further change the space.