Box demand and pricing patterns continue to evolve due to ripple effects from the pandemic. Commodities experts and financial analysts expect more adjustments to come as economic and regulatory factors play out around the world.

On Friday, Fastmarkets RISI published data showing North American containerboard prices have held steady since the last update in August. Following multiple rounds of price increases in 2024, analysts largely expected this outcome. Respondents to BofA Global Research’s latest market survey predicted pricing wouldn’t go up again until early 2025.

“Demand continues to improve with mill backlogs standing at four to six weeks and in some cases slightly longer than last month,” said Michael Roxland, senior paper and packaging analyst at Truist, in a Sept. 22 note to investors. He also noted stronger daily demand in Q3 versus Q2. “Overall, mills appear to be managing supply to demand with continuing downtime, while the box market proceeds as normal and delayed box price increases continue.”

Cascades, the sixth largest producer of containerboard in North America, is implementing a price increase for customers effective Oct. 7. This includes a $40 per ton increase for linerboard, $70 per ton for medium and $40 per ton for white top linerboard.

That move marks the third round of price increases for this category in 2024 by Cascades. Typically, when one company raises prices others follow, but so far it doesn’t appear to be catching on with other large producers. According to Roxland, an estimated 80% of buyers and sellers “reported no change in pricing” and the remainder “reported lower pricing as some contacts expanded their price range.”

Cascades’ decision may have also been influenced by unplanned downtime at its new Bear Island mill in Virginia, according to Roxland. Additionally, he said in a Sept. 16 note that other factors could include “greater open market purchases of corrugating medium by large integrated players,” as well as elevated labor and operating costs.

In that note, Roxland said that old corrugated container input costs are also a factor, despite “some recent softness” in those prices, with the commodity still trading up 245% from January 2023 levels.

Other pricing updates

In addition to the main news on containerboard, RISI also provided updates on coated recycled board, coated unbleached kraft and other categories.

CRB pricing was up $20 per ton — for the first time since October 2023 — following a recent round of increases from companies such as PaperWorks Industries, Smurfit Westrock and Graphic Packaging International. The latter two also announced price increases for CUK, but that was not reflected in RISI’s pricing.

Pricing for solid bleached sulfate held steady, despite some reports of weakening demand, as did uncoated recycled board.

Meanwhile, RBC Capital Markets reported that Finnish company Metsä Board plans to increase prices for its folding box board and food service board categories by 85 Euros per metric ton on Nov. 1.

The bigger picture

These pricing moves comes as the broader market still adjusts to complex economic conditions, with somewhat limited visibility into when demand may improve.

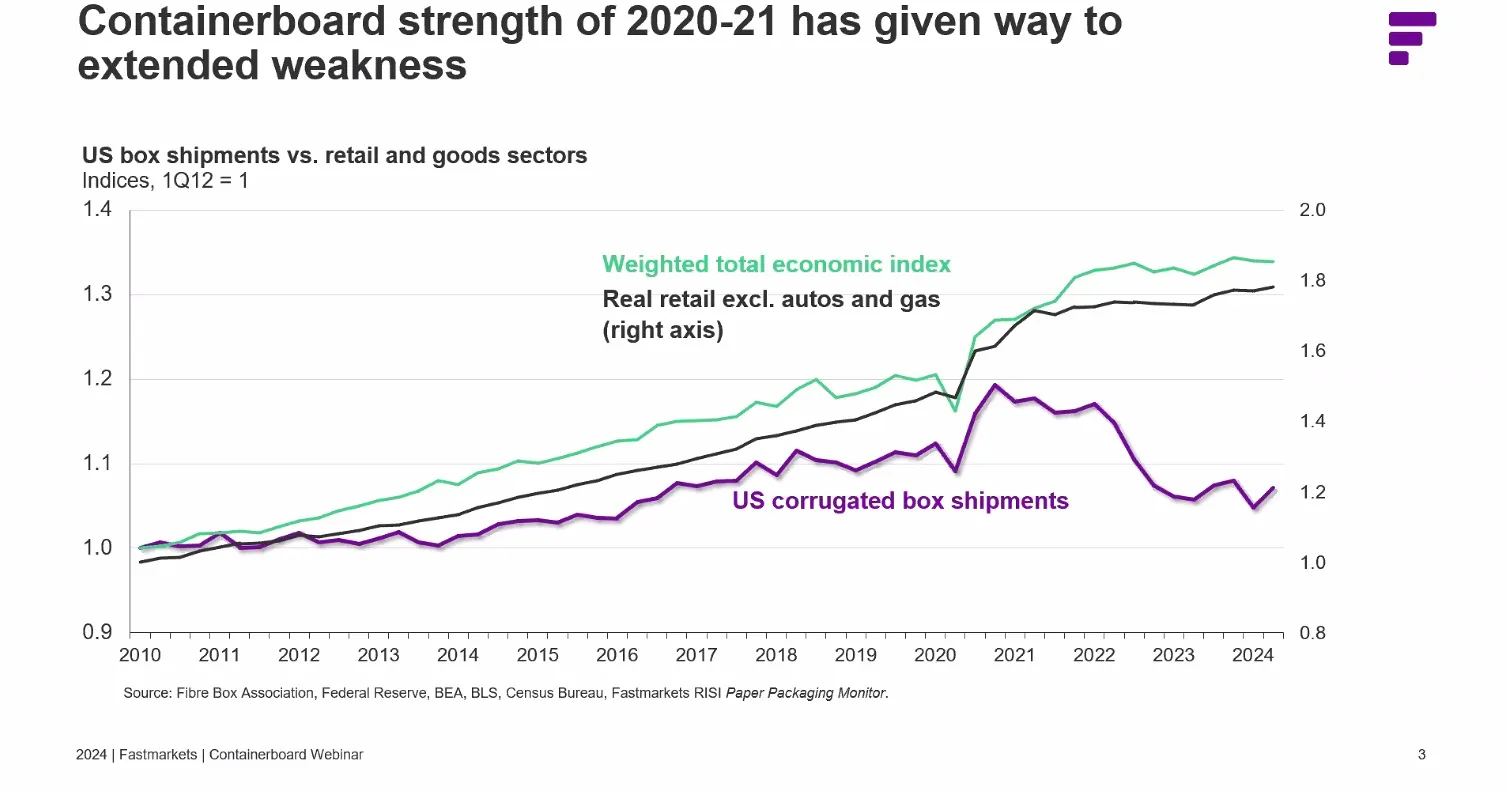

“We have been at a very depressed level now for one-and-a-half to two years,” said Derek Mahlburg, director of North American graphic paper and packaging at Fastmarkets RISI, during a Sept. 18 webinar. “What we've actually seen is box shipments fall down to about 2016 or 2017 levels and really just be stuck there, and this is an even more dramatic sort of disconnect from the typical trend.”

Mahlburg noted that box shipment volumes in the retail and goods sectors traditionally correlate with overall economic activity, but those factors decoupled during the pandemic. This was due in part to complicated supply chains at the start of the pandemic, which led to high volumes of ordering that then tapered off into a prolonged destocking period. Packaging companies say destocking has largely worked itself out, but inflation is still affecting consumer spending.

Analysts noted that the global market has an estimated 22 million metric tons of overcapacity — including 16 million in Asia, followed by smaller amounts in Europe and Latin America, and none in North America.

Multiple North American packaging companies have been scaling back production as part of the destocking fallout, including through closing or idling facilities, and current operating rates remain below recent peaks. Fastmarkets RISI estimates that overall global operating rates could return to levels seen between 2010 and 2019 by 2026.

This trend follows a recent round of capacity increases in North America involving machines to handle recycled feedstocks, much of which played out in 2023. Aside from GPI’s upcoming facility in Waco, Texas, the market isn’t expected to see other major projects in the near term.

“In North America, producers look to be taking more of a wait-and-see approach to see whether we actually are going to get the kind of demand recovery to get operating rates back up to this healthy level, at which point, maybe then the market will be ready for the next dose of new capacity,” said Mahlburg.

The 40th edition of the BofA Box Survey, released on Sept. 12, gave a similar picture. Based on feedback from 25 industry respondents, the survey projected 2% growth over the next two quarters. That’s down slightly from a 3.4% projection in June. Respondents also noted that transportation and labor costs continue to have neutral to negative effects on their businesses.

“Qualitative responses suggested box plants were ‘busy’ and ‘definitely stronger’ heading into fall though customers have also increasingly put business up for bid. There seemed to be more instances of volume shifting when prices increased earlier in the year, but firmer demand has lessened this trend,” wrote George Staphos, a BofA research analyst.

Looking ahead, manufacturers are also watching for potential effects from the OCC market. A separate Fastmarkets RISI webinar, hosted earlier this month, noted factors such as higher mill demand for recovered paper and ongoing modernization at MRFs.

The upcoming European Union Deforestation Regulation, which could set tighter standards on the use of virgin fiber as soon as this year, may further affect demand for recovered fiber.

“It is focused on virgin fiber-based products, but that doesn't mean recycled fiber-based products will not be impacted by it,” said Alejandro Mata, director of Europe packaging and graphic papers for RISI. “[O]ne of the possible consequences that we can see coming out of EUDR is a higher proportion of recovered fibers usage to produce paper and board in Europe in the coming years.”

Mahlburg noted that North America is an exporter of kraft liner to Europe, and an importer of some bleached and coated liner grades from Europe, so those categories could be affected and this could further influence OCC pricing.

Looking ahead, Mahlburg said he’d be watching the food sector and domestic manufacturing, more so than direct consumer spending at the retail level, as well as rightsizing trends in e-commerce shipments.

“Are these sectors going to use the same amount of corrugated for output that they have been using?” he said. “Just go look at your doorstep, where we have seen more kraft paper mailers, more plastic envelopes and fewer boxes.”