During a big week for U.S. economic data releases, signs increasingly point to some level of slowdown in the coming months.

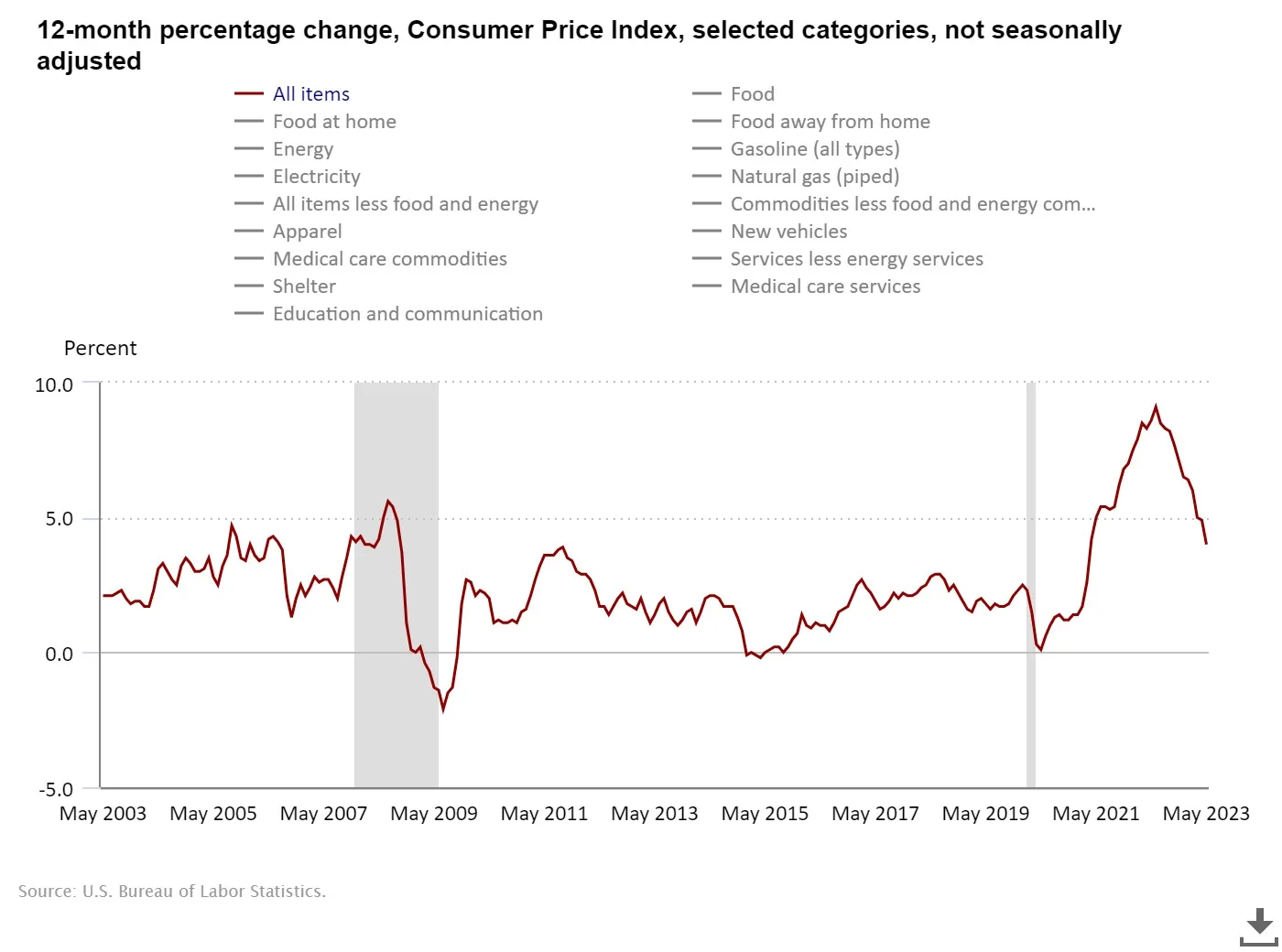

On Tuesday, the Bureau of Labor Statistics released Consumer Price Index data that shows inflation increased 4% over this time last year and just 0.1% month over month. While that’s still above the government’s desired targets, inflation increased at its slowest clip since March 2021. At this time last year, inflation hovered between 8% and 9%.

Slowing inflation is a leading factor for the Federal Reserve’s decision Wednesday not to raise interest rates. This was the Fed’s first meeting since January 2022 at which they paused increases. Analysts say the move suggests the Fed is watching to see if its 10 consecutive rate increases have been enough to tame inflation, which reached its highest level in 40 years.

However, the Fed indicated that efforts to maintain a federal funds rate in the range of 5% to 5.25%, which is the highest in 16 years, potentially could change as early as next month. It points to two more possible rate increases this year if inflation doesn’t reduce further. The Fed has frequently stated that it aims to get inflation back down to 2%. Federal Reserve Chairman Jerome Powell reiterated that sentiment this week, saying, “we’ll do whatever it takes to get it down to 2%.”

On the packaging front, Jeffrey Kleintop, Charles Schwab managing director and chief global investment strategist, signaled in a post last week that the U.S. is in a “cardboard box recession” that is broadening. He explained that typical global recessions involve downturns in all areas of the economy simultaneously, but only manufacturing and trade appear to have been in a recession during the past year. Kleintop cites data from the Fibre Box Association showing that demand for corrugated linerboard, which most boxes are made from, recently experienced similar dips as during previous global recessions.

“We're referring to this phenomenon as a Cardboard Box Recession, because items that are made (manufacturing) and shipped (trade) tend to go in a box,” he said, adding that a cardboard box recession suggests the mild recession in corporate earnings may continue, although at a significantly lower level than during prior recessions.

Kleintop notes that the job growth cycle could flip to job contraction in the coming quarters, and job growth in industries related to cardboard boxes already has been weak in 2023 compared with service sectors. Manufacturing as a whole has contracted for seven consecutive months.

Experts say many additional factors affect the fiber space, including a push for lightweighting and using less material. And some of the depressed box demand is simply renormalization following an unprecedented boom during the pandemic — a trend that other substrates like plastic and metals experienced as well. Still, the box sector’s health is tied to retail’s health, and a dip in consumer spending due to economic pressures such as inflation bumping up prices would negatively affect the industry.

The Commerce Department released May data today showing a 0.3% increase in retail and food service sales over the previous month and a 1.6% increase over May 2022 despite ongoing inflationary pressure. Economists largely had expected sales to decline; the increase suggests the economy is still resilient.

The Bank of America Box Survey for June released Wednesday showed softer box shipment growth expectations. For the next two quarters, expectations are for a 2.9% decrease, compared with the April survey’s expectations of a 2.5% decrease. The report cites slight improvement in respondents’ sentiment about the coming quarters: 15% said current demand conditions appear “better” or “much better” compared with 4% in April; 25% expect conditions in the next six to 12 months compared with 16% in April; and expectations of “worse” conditions have been dropping sharply since the January survey.

Downward pricing is expected to continue in the short term, with 95% of respondents anticipating further containerboard price drops and 90% anticipating box drops. Most respondents believe increases aren’t likely until Q1 2024 or later.

Editor’s note: This story has been updated with new U.S. Department of Commerce data on May retail and food service sales.