It’s only a matter of weeks until the world knows who will be driving U.S. policy on trade, environmental regulation and more. For now, though, pre-election uncertainty continues to affect manufacturers and consumers.

Some manufacturers have opted to hold off on capital investments until there’s more clarity. And polling firm Ipsos found that nearly half of consumers it surveyed were spending less and saving more due to the uncertainty.

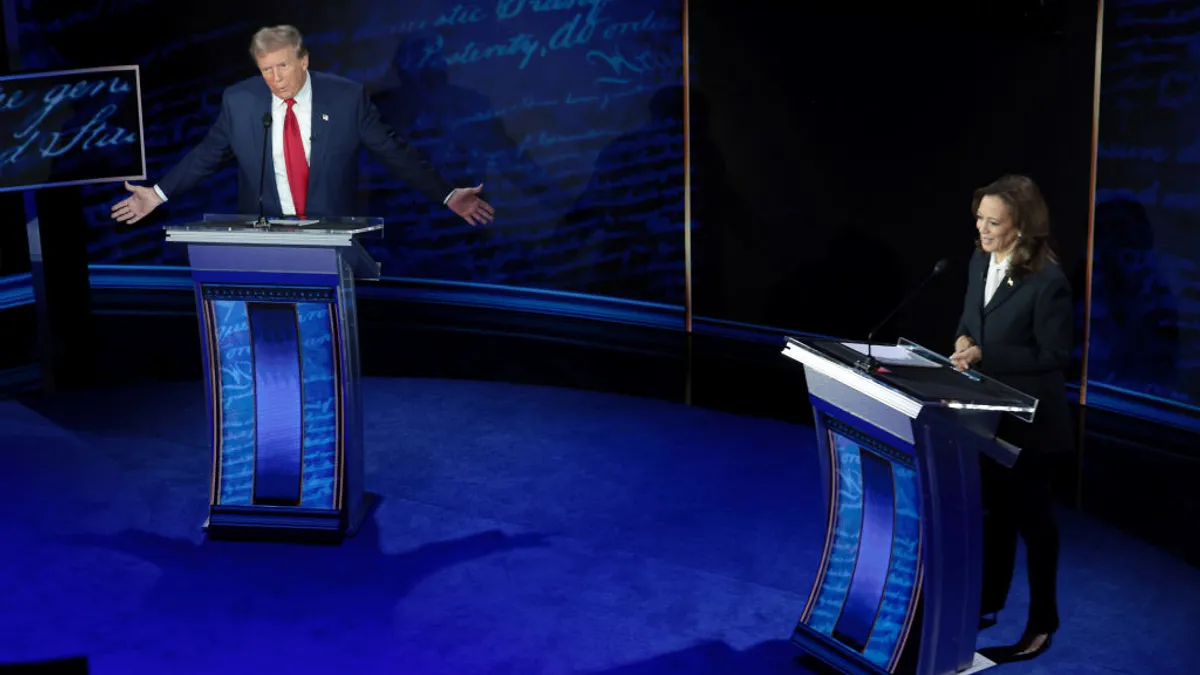

While packaging rarely features directly into presidential campaigns, here are some takeaways on what Vice President Kamala Harris and former President Donald Trump have indicated about their plans for manufacturing, energy, environmental and ESG policy come 2025.

What other post-election policy shifts are likely to affect the industry? Let us know at [email protected].

Manufacturing policy

Tariffs were a signature part of the previous Trump administration, many of which continued in the Biden-Harris administration. Trump has further ambitions to raise tariffs if re-elected. “To me, the most beautiful word in the dictionary is ‘tariff,’” he said at an event this month, having recently proposed a tariff of up to 20% on everything the U.S. imports, with a 60% tariff specifically on goods from China. Trump has also vowed to cut the corporate tax rate for domestic manufacturers from 21% to 15%.

This year, under President Joe Biden and Vice President Harris, the U.S. trade representative increased Section 301 tariffs covering certain steel and aluminum products imported from China to 25%, up from a maximum of 7.5%. The Can Manufacturers Institute said that’s not enough; it believes the Section 301 tariffs would have to reach at least 200% to mitigate the impact of Chinese imports.

Harris has criticized Trump’s tariffs proposals, calling them “a sales tax on the American people.” Separately, Harris has proposed $100 billion in new investments in manufacturing. She’s also said she’ll expand tax credits for companies that create union jobs.

One domestic manufacturing topic that Trump and Harris agree on: Both have opposed the takeover of U.S. Steel by Japanese company Nippon. U.S. Steel describes itself as the largest metal supplier to the U.S. packaging industry.

The National Association of Manufacturers has not weighed in on candidate platforms. In a press release following the Democratic nomination, it praised packages like the bipartisan infrastructure law and warned of “a growing slate of unbalanced federal regulations and a looming wave of tax increases in 2025 that will significantly and negatively impede the ability of manufacturers to continue to invest, grow jobs and raise wages.”

Energy policy

Packaging manufacturers have paid more attention to energy efficiency and decarbonization in recent years. This is evident in their sustainability reports and moves to increase their use of renewable energy sources like solar. Packaging companies have also individually received energy project funding and recognition, such as Georgia-Pacific's integrated paper mill in Brewton, Alabama, gaining EPA’s Energy Star certification.

In part, the attention to energy correlated with the Biden administration’s climate strategy, as well as the disbursal of funds from the Inflation Reduction Act to bolster clean energy use and ultimately lower emissions in energy-intensive industries such as manufacturing.

A portion of the Department of Energy's IRA funding has gone toward emissions reduction initiatives and carbon capture projects, including for packaging manufacturers. This year, DOE awarded up to $125 million to O-I Glass to rebuild four furnaces at three facilities to reduce carbon dioxide emissions at those sites by an average of 40%.

DOE awarded International Paper up to $46.6 million to decarbonize a thermal process at its Mansfield, Louisiana, site. Separately, IP received funding for a carbon capture pilot project at its Vicksburg, Mississippi, containerboard mill.

While energy hasn't been the candidates' leading topic in recent weeks, both have spoken about it previously, with varying degrees of specifics.

Harris is expected to continue or expand various energy initiatives that affect manufacturers, such as those in the IRA. Her policies seek to hold polluting industries accountable, which could result in more environmental lawsuits against heavy industry should she win, according to the International Comparative Legal Guides.

Trump's energy policy centers on deregulation. During his presidency, Trump rolled back more than 100 climate policies, including for energy efficiency standards and CO2 emissions. He has stated on the campaign trail a desire to rescind any “unspent” funds from the IRA.

Although Trump has tried to distance himself from The Heritage Foundation’s Project 2025, many former Trump administration officials helped draft the guide, which recommends similar environmental rollbacks. The document states that the next president should support the “repeal of massive spending bills” including the Infrastructure Investment and Jobs Act and the Inflation Reduction Act.

Environmental and ESG policy

State laws on extended producer responsibility, recycled content requirements and product bans have been a bigger factor than federal policy when it comes to effects on packaging manufacturers and brands. But federal policy still plays a notable role in the sector and could change based on the presidential and congressional election outcomes.

Harris is largely expected to continue many of the Biden administration’s environmental policies, including on issues such as environmental justice and plastic pollution. Under Biden, the EPA has also advanced regulations to limit certain industrial emissions, which has been a source of contention for parts of the packaging industry. And the agency has pursued potential limitations on vinyl chloride and PFAS.

The Food and Drug Administration has also taken steps to limit PFAS, though some of these efforts were underway before Biden and Harris took office.

In addition, the EPA has recently been active with reports recommending changes or reductions in plastic packaging, as well as addressing the role of packaging in preventing food waste. Certain grant and education programs have focused on reusable packaging.

During the Trump administration, the EPA set a goal to achieve a 50% national recycling rate by 2030 (during a time of commodity market upheaval), but it wasn’t as active on plastic reduction, environmental justice or industrial emissions issues.

For example, the agency proposed in 2020 to not classify certain chemical recycling processes as a form of incineration. Certain packaging companies and their customers support chemical recycling and seek to use more of this feedstock in packaging. Most recently, this showed up in a bill that was introduced in Congress with packaging industry support.

The next presidential administration could influence other packaging-related environmental policies, including the Federal Trade Commission’s still-outstanding updated Green Guides and U.S. participation in a potential international plastics treaty. The Biden administration recently came out in favor of plastics reduction measures in that treaty, which some Republican lawmakers have publicly opposed.

The next administration is also poised to impact ESG-related regulation and how it affects investment and staffing in the space.

The U.S. Securities and Exchange Commission this spring approved influential rules on climate-related risks, which would compel certain large companies to disclose scope 1 and 2 emissions, along with physical, transition and supply chain risks. Many packaging manufacturers would be among the businesses impacted, although implementation is paused due to legal challenges. It’s among the regulations that Project 2025 calls problematic, as Republicans have taken a harsher stance against ESG efforts and investing.

The potential for federal policy rollbacks could further pave the way for states to lead, the Brookings Institution noted in an August election preview. Regardless of federal activity, state policies like EPR are resulting in producer responsibility organizations and companies adding capacity to manage data and compliance.