Packaging designers may have to adapt graphics on food products to make room for a new informational box proposed by the U.S. Food and Drug Administration.

Food and beverage brands and other industry partners offered mixed reactions to the agency’s nutrition info box design as they began to digest Tuesday’s long-awaited proposed rule on front-of-pack labeling. The mandatory, compact and standardized box is meant to complement FDA’s existing Nutrition Facts label last updated in 2016.

Certain groups pushed back on FDA’s methodology for the front-of-pack evolution, while other sources noted the proposed format still appears softer than some other countries’ approaches.

FDA’s proposal appears to reflect a neutral and consistent aesthetic with Nutrition Facts, and may be perceived as less alarming than incorporating traffic light colors or even stop sign graphics used internationally, noted Natalie Rainer, a partner at K&L Gates. Still, “I feel like it's going to take up so much essential real estate that companies have never had to sacrifice before,” she said.

It’s “a pretty big departure in terms of the way FDA has handled nutrition labeling,” Rainer said, nodding to FDA’s move to assign low, medium or high values to different nutrients. “The nutrient content regulations up until this point have given companies the guardrails for how to make favorable claims about their products — and this is forcing companies to say something sort of negative.”

Christy Lebor, strategy group director with Smashbrand, a CPG packaging design and branding agency, called the aesthetic impact “concerning,” especially when considering how it would play out on small packaged goods like a pack of gum or a box of Jell-O.

“Large, prominent callouts, often referred to as ‘violators’ or ‘yucking the yum’ in the industry, disrupt the packaging’s visual appeal,” independent of a product’s healthfulness, Lebor said in a written statement.

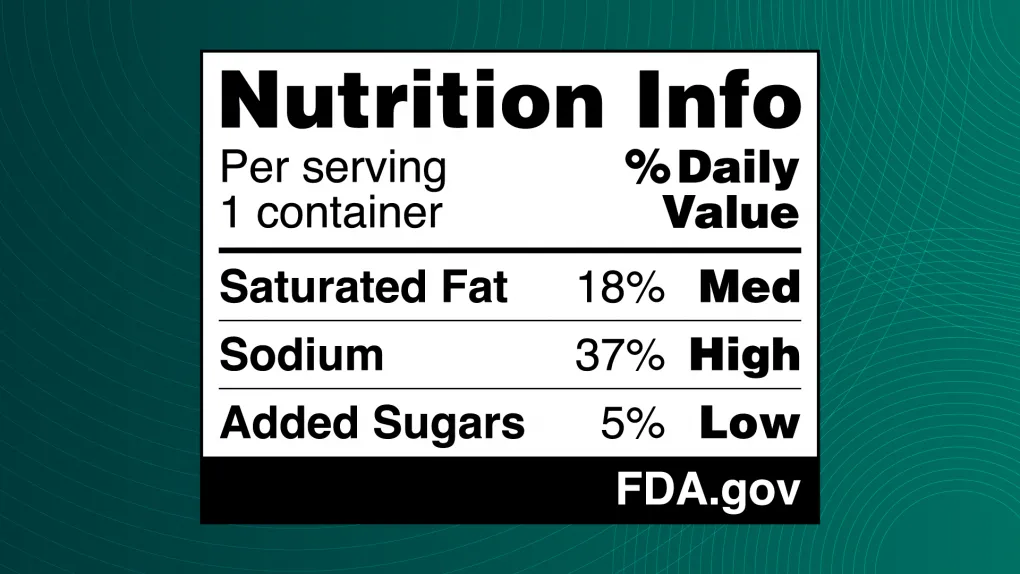

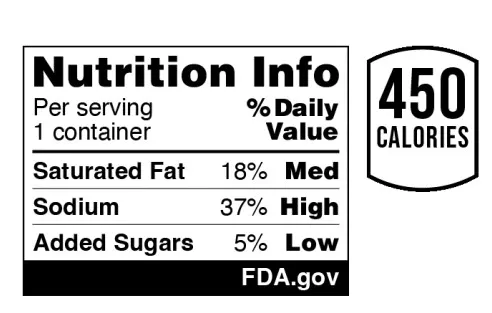

Proposed specs for the nutrition info box

- A range of 5% Daily Value or less for “Low”; 6% to 19% DV for “Med”; and 20% DV or more for “High”

- The box would be placed somewhere in the top third of the principal display panel (FDA is not prescribing an exact location)

- FDA recommends, but does not specify, a single, easy-to-read type style; its example uses Helvetica, just like the Nutrition Facts label

- FDA proposes a minimum type size of 8 point, and offers other specs on the required baseline size for the box relative to the overall package area

- FDA also pitched a more basic, “intermediate” version of the info box that could be used on smaller packages (those with 40 or fewer square inches available to bear labeling)

FDA’s approach draws mixed reactions

Federal action on front-of-pack labeling has been a long time coming.

Still, the proposed rule “came at the eleventh hour of the Biden administration,” commented Sam Jockel, partner at Alston & Bird, and it remains to be seen whether the incoming Trump administration may change course.

The FDA has engaged on the issue of front-of-pack nutrition labeling for nearly two decades. The Center for Science in the Public Interest, or CSPI, a nonprofit consumer advocacy group, said it petitioned FDA on front-of-pack nutrition labeling back in 2006 and again in 2022.

FDA said it tested multiple design options, some of which included a magnifying glass icon or used traffic light-inspired colors — red, yellow and green — but it’s moving forward with a text-only black-and-white design. The rule states that while some information suggests color coding with text can improve comprehension, FDA’s own study didn’t show a statistically significant benefit. The box doesn’t note calorie counts, but the agency said brands could choose to present that information in tandem.

The Consumer Brands Association, which represents dozens of CPGs, criticized FDA’s approach.

“The FDA’s proposed rule for front of package nutrition labeling appears to be based upon opaque methodology and disregard of industry input and collaboration,” said Sarah Gallo, CBA’s senior vice president of product policy, in an emailed statement.

According to Gallo, FDA’s proposal did not reflect recent industry-backed research, which has demonstrated “that data-driven labels that reinforce important nutrient information, including calories, nutrients to encourage, and nutrients to limit are most effective in helping consumers make the healthiest choice.”

Consumer Brands highlighted that many companies already voluntarily implement front-of-pack nutrition information using the industry-founded Facts up Front label.

The association, citing member companies, says costs for label changes range between $1 million to $26 million dollars depending on the scope of a brand’s product portfolio, and any major label change for the industry will require three to five years for implementation.

Lebor offered an example that in working with a client’s beverage business to implement Facts up Front, “the redesign cost over three-quarters of a million dollars, with total company-wide costs exceeding $4 million.”

“This highlights the financial burden such initiatives impose, particularly on manufacturers, with even greater challenges for smaller businesses,” she said.

CSPI has long been critical of Facts up Front. In a statement, it called out the Facts up Front labels, which it said “do not indicate if a product is high in a nutrient, have no effect on consumer purchases, and mainly served to drag out this process for more than a decade.”

“The incoming administration has the opportunity to finalize this important rulemaking and follow through on commitments to stand up to Big Food,” CSPI wrote. “When finalizing the policy, we hope FDA will consider the growing body of international evidence supporting the “High In”-style labels adopted by our neighbors to the North and South.”

American Beverage said it will continue working with the Trump administration and FDA on this nutrition information issue. “It’s why beverage companies pioneered front-of-pack labeling more than a decade ago when we voluntarily added calorie labels on every bottle and can we sell,” spokesperson William Dermody said in a statement.

The outlook for redesign

If the rule is finalized, designers would be tasked with developing “compliant yet cohesive designs that align with existing brand aesthetics and messaging,” according to Ravi Sawhney, founder and CEO of RKS Design, a global firm whose work includes packaging design for CPGs.

Consumer testing could inform how a brand should best incorporate the new label while still appealing to consumers.

Impacts may differ between smaller and larger brands, Sawhney said in an email. Smaller ones could deal with more constrained resources, meaning the most popular products may have to be prioritized for initial redesigns, he said. Meanwhile, larger companies are likely better-resourced to adapt to regulatory changes, but then have the challenge of ensuring consistency across diverse product lines.

Companies would have to consider how these more visible labels could impact consumers’ perception and trust of brands, Sawhney said. Some might even view it as an opportunity to modernize packaging or rebrand to improve transparency, and engage health-conscious consumers.

Michael Keplinger, Smashbrand’s director of testing and insights, echoed that opportunity.

“When considering the broader impact on packaging design, this rule will require all packaging to be redesigned. Brands that approach this strategically will need to rethink their messaging hierarchy and communication flow to incorporate the changes effectively,” he said in a written statement. “In contrast, brands that simply ‘slap it on’ may risk long-term damage to their messaging clarity and consumer engagement.”

FDA is accepting comments on the proposed rule until May 16. Rainer suspects hot issues for discussion may include the size and prominence of the info box, as well as the thresholds for the low, medium and high designations.

“It's going to be so easy for products to exceed that 5% threshold for ‘low’ ... that's not going to be a desirable position for a lot of companies that market their products [with] an overall packaging narrative that connotes more of a healthier product,” she said.

Rainer suspects companies will be thinking about how to achieve a tighter, more concise, simpler design. These companies are some of the “most clever marketers in the world,” she said. “I imagine they're going to have some thoughts about alternative ways to present this information.”