Recovering paper and plastic food service packaging from waste streams has come a long way as new products enter the stream and MRFs add new technology, but recovery systems still aren’t perfect.

Industry consultants on a recent Foodservice Packaging Institute webinar described three studies examining how much food service packaging contaminates recycling streams as well as recovery systems for paper cups and thermoforms. Speakers discussed best practices and the teamwork needed to improve recycling.

“Talk to your your whole supply chain to help get these products recovered — not just the recovery but also the up end of the supply chain, the manufacturers, the material suppliers, all of that,” said moderator Ashley Elzinga, FPI’s director of sustainability and outreach.

Food residue

FPI’s 2022 food residue study summary notes that food contamination is an often-cited reason for not accepting food service packaging in recycling programs. The study’s main purpose was to determine the contamination levels of food service packaging (items provided by restaurants or similar establishments, such as pizza boxes and take-out containers) compared with other types of food-contact packaging commonly recycled at MRFs (items holding pre-packaged food sold in stores, including peanut butter jars, cans and pasta boxes).

A research team conducted the study at a Michigan MRF in November 2022 as a follow-up to similar ones conducted in Massachusetts in 2013 and Delaware in 2014. This study’s findings were similar to the previous two editions, with the exception of molded fiber items; because that was a new category in 2022, a direct comparison is not available for the prior studies. However, the team wanted to break out the material into a new category because its use is growing, and it differs from other fiber food service packaging in that it doesn’t have a liner, according to Holly Halliwill, consulting engineer at RRS who was part of the field study.

A sorting team separated materials in 13 200-pound samples of recyclables collected curbside by food service and food-contact packaging. They rated the items on a cleanliness scale of 1 to 5, with 1 being the cleanest and 5 being highly contaminated.

The results indicate that both food service and food-contact packaging were rated as a 1 or 2, meaning they’re both relatively clean in the recycling stream. Paper, paperboard and plastic containers exhibited “extremely low rates of significant residue.”

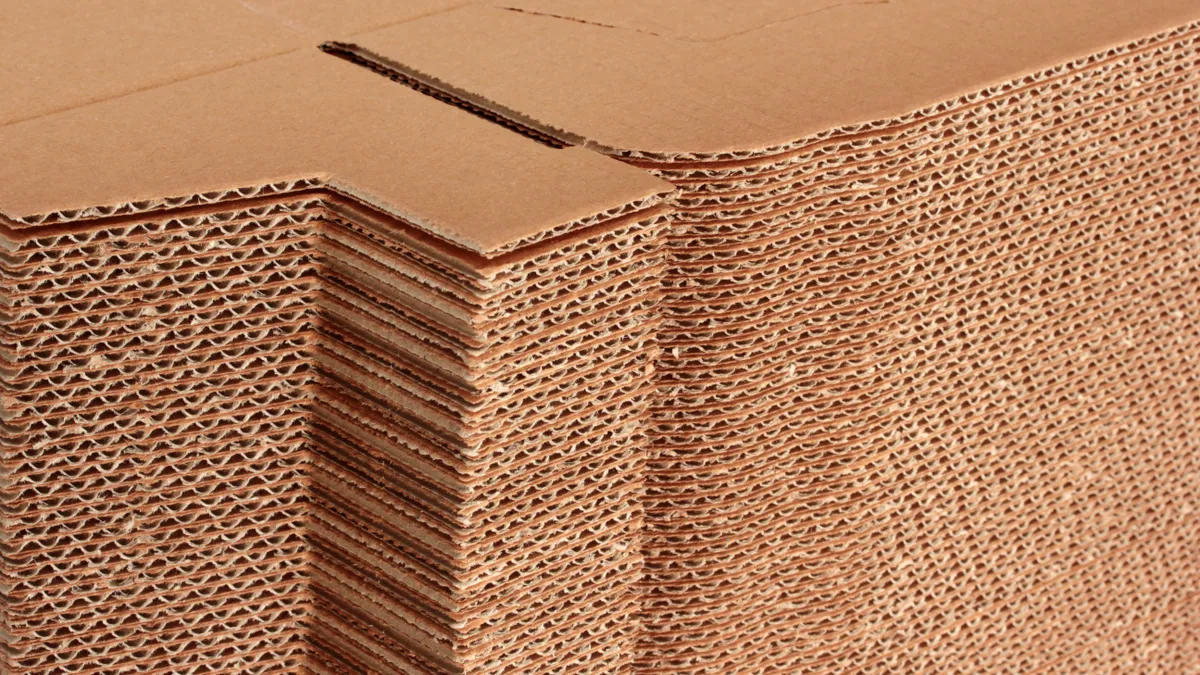

The most contaminated items were corrugated food service and molded fiber food service packaging, with 17% and 23% contamination, respectively — the only items in the study with a contamination level above 10%. Molded fiber also showed the biggest difference between food service and food contact packaging.

“This is due to the main food-contact packaging typically being exceptionally clean and the food service packaging being more prone to residue,” Halliwill said. That being said, she noted that egg cartons were the only molded fiber food-contact packaging the sorters encountered, whereas that category for food service involved more items such as plates, bowls and drink carriers.

Paper cups

Paper cups traditionally haven’t been widely accepted in domestic recycling programs, but that’s changing. An increasing number of U.S. paper mills are interested in processing paper cups, according to Bill Moore, president of consulting firm Moore & Associates.

The majority of paper cups are used for hot beverages and have a poly coating on one side to prevent the cup from breaking down and leaking. But cups and other polycoated paper packaging challenge mills to adequately separate the paper and plastic elements.

Yet state-of-the-art mills are opening and others are now willing to upgrade equipment to accommodate cups. Moore explained this is largely because recycling mills traditionally relied on the corrugated box sector for feedstock, but concerns about the amount of available fiber are prompting them to process mixed paper like cups.

Paper cups, commonly made from solid bleached sulfate board, present a particularly enticing opportunity because SBS fibers are among the highest quality available for recycling due to properties like their strength and being bright white, Moore said.

The U.S. generated 628,000 short tons of paper cups in 2022, according to Moore’s data. That declined sharply in 2020 during the pandemic, but volumes picked up again last year. North American end markets primarily exist in the central and eastern U.S. and include recycled paperboard for food and other packaging, recycled pulp, containerboard for boxes and tissue and towel producers, according to FPI data.

Over the last five years, the consulting firm surveyed North American mills that recycle paper. It’s finishing surveying 50 new mills with the ability to consume paper cups not already on FPI’s list of North American mills accepting paper cups, and up to 15 new mills might begin accepting cups in the coming years. Moore said this is particularly interesting because recovered paper market pricing has been soft, and usually that combined with abundant supplies of recovered paper results in mills not showing interest in discussing new materials.

“But they were very much interested in looking at the new fibers,” he said. “That was a sign to me that all of the efforts — both on the collection side, the MRF side, and the end use research — have really moved paper cup recycling forward quite well, and it will continue to grow.”

Moore referenced a “step change” in the number of mills accepting paper cups compared to the previous three years. In part, that’s driven by the U.S. adding about 900,000 tons of mixed paper processing capacity through 2025.

“In the space of 2020 to 2025, we’ll add more new papermaking capacity than the U.S. did in the last 25 years,” Moore said. “As the paper industry continues to mine for high-quality, available fiber, I see the demand [for cups] going upward.”

PET thermoforms

Of the many PET thermoforms generated, only a small proportion are recovered, according to results from phase one of an RRS study conducted for FPI and 13 corporate and association funding partners. The study sought to estimate total PET thermoform generation and recovery, to understand the material’s current sorting and reclamation and determine costs. Phase two, in which the team investigates various interventions to determine which pathway has the most likelihood of recycling the most PET thermoforms, currently is underway.

The study found that the U.S. and Canada generated 750,000 tons to 800,000 tons of thermoforms in 2018, and 69,500 tons — a little over 9% — were recovered. Thermoforms comprised about 20% of the entire PET packaging market, which is higher than the researchers’ estimates of 5% to 10% thermoform presence in PET bottle bales.

While many MRF respondents are open to sorting thermoforms, they currently face barriers such as inconsistent markets, insufficient prices, inadequate conveying or bunker space and lack of throughput volumes.

For example, the research team learned of inconsistencies with the amount of thermoforms allowed in PET bale to meet rPET specifications, explained Katy Ricchi, consulting engineer at RRS. Some reclaimers require 2% or less thermoforms while others allow up to 20%, and the cap generally is 10% of a PET bale weight consisting of thermoforms. This inconsistency limits MRFs’ willingness to recycle more of the material.

The study found that limited interest exists for sorting out a thermoform-only stream on the front end. Olefins are the main value driver in mixed plastic bales, but MRFs might consider sorting thermoforms with positive market signals.

MRF survey respondents also liked the idea of a grant program to assist with adding infrastructure to support thermoform recycling. The study team recommends establishing a demand championship program to drive usage of rPET derived from thermoforms. Reclaimers also have a place in the discussion and in partnerships for greater thermoform use, but technical and commercial challenges contribute to their low appetite for participation, the study concluded.

The study looked at California MRFs’ separation of thermoforms because they’re some of the only ones doing this. In reality, the research team discovered only 15% of the contacted California MRFs reported sorting and selling PET thermoforms in the last two years.

PET thermoforms are generated in similar volumes to HDPE, so they likely can be targeted for greater recovery, the study concluded.

“In the past, [PET thermoforms] haven’t been as sought after — definitely not as much as PET bottles,” Ricchi said. “But that’s kind of... [what] we're trying to push, is that they can be used and they should be used and recovered.”