- Results: Greif CEO Ole Rosgaard said the company “continues to navigate this extended slow demand environment” in a release Thursday describing results for the three months ended Jan. 31. Greif attributed the decline in both global industrial packaging and paper packaging sales to lower volumes and lower average selling prices.

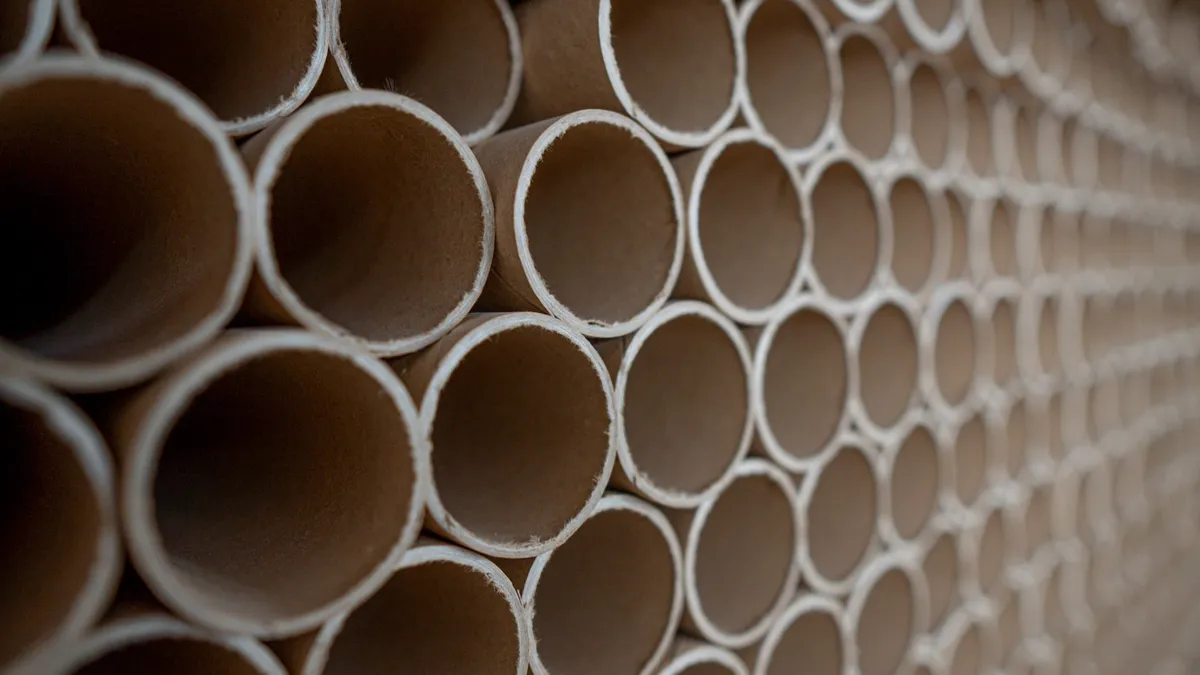

- Demand trends: Volume was depressed throughout January, Rosgaard said during the fiscal Q1 earnings call. “We have seen some sequential improvements but it's not really enough to signal an inflection.” Still, in conversations, customers “seem much more positive than they have been for a long time, although we haven't seen that materialize into volume yet,” Rosgaard said. Volume trends in the quarter improved for containerboard, CFO Larry Hilsheimer reported, but were offset by weaker boxboard demand. Corrugated converting volumes rose 3% as customers began to reorder paper to rebuild inventories. The company expects that rising mill volumes in containerboard could in turn lift uncoated recycled paperboard, tube and core volumes as well.

- Pricing changes: In line with recent actions by other paper packaging makers, on Jan. 5 Greif announced various price increases that would kick in the following month for URB as well as tube and core and protective packaging products. However, recognition of those price increases was delayed; combined with rising old corrugated container costs, this pressured margins in the paper packaging and services business in Q1. “The January published RISI index prices in both containerboard and boxboard were not at all in sync with what we experienced in the market,” Hilsheimer said, later adding, “Everybody knew cost-driven factors justified the price and yet it didn't get recognized.”

- Further criticism: Hilsheimer described the survey-based approach to assessing price “with such a small non-representative sample size” as irrelevant given access to more data-driven tools. “It stuns me that we are still dealing with some survey-based process to recognize price in this industry when everybody else in the world has moved on to data and analytics and facts because what we were seeing out on the street was no big pushback on the price,” Hilsheimer said.

- M&A: The company touted integrations of its acquisitions of blow-molded container manufacturer Lee, IBC and drum company Centurion and paper partitions supplier ColePak. Greif is also approaching the close of its acquisition of jerrycan and small plastic container company Ipackchem. Rosgaard reiterated that Greif’s focus in incremental M&A going forward is in high-margin resin-based and paper converting products.

- Recyclability innovation: During the quarter, the company also announced a partnership with barrier technology company IonKraft to improve recyclability of plastic jerrycan packaging. “Combined with Lee, Reliance, and Ipackchem, we think a successful outcome with IonKraft will offer our customers a full suite of custom packaging and barrier options and provide multiple growth levers for Greif for years to come,” Hilsheimer said.

- Outlook: Overall, the company is hesitant to offer guidance for the year ahead. “Given the deterioration of product demand in the past year and the degree of uncertainty in the forward-looking macroeconomic environment, we continue to be unable to determine the trajectory of product demand for the remainder of the fiscal year,” Greif said in the earnings release, opting to offer only a low-end guidance estimate: $200 million in adjusted free cash flow and $610 million in adjusted earnings before interest, taxes, depreciation and amortization. Those estimates assume continuation of demand trends from the past year.

Greif navigates ongoing slow demand, delayed recognition of price increases

The company touted multiple acquisitions and a partnership to improve jerrycan recyclability. Those were bright spots in an otherwise challenging environment.

Recommended Reading

- Confusion abounds over whether markets are accepting fiber price hikes By Katie Pyzyk • Updated Feb. 21, 2024

- Greif details M&A strategy amid ongoing economic headwinds By Maria Rachal • Dec. 8, 2023