Dive Brief:

- Memphis, Tennessee-based International Paper has proposed purchasing London-based DS Smith in an all-stock deal, which Bloomberg estimated to be worth more than $7 billion. DS Smith confirmed discussion with IP in a statement filed with the London Stock Exchange on Tuesday, noting that no formal offer has been made. IP confirmed the proposal in its own LSE statement.

- IP’s proposal is a 48% premium to DS Smith’s closing share price on Feb. 7, which was one day before Mondi Group publicly expressed interest in acquiring DS Smith in an all-share deal of approximately $6.5 billion, representing a 33% premium compared with DS Smith’s Feb. 7 share price.

- IP has until April 23 to express firm intentions to make a formal offer, and it noted in the LSE statement that it has the right to change the proposed deal terms if another party announces an intention to make an offer. Mondi has until April 4 to make its offer, and DS Smith said in the LSE statement that it’s still in discussions with Mondi.

Dive Insight:

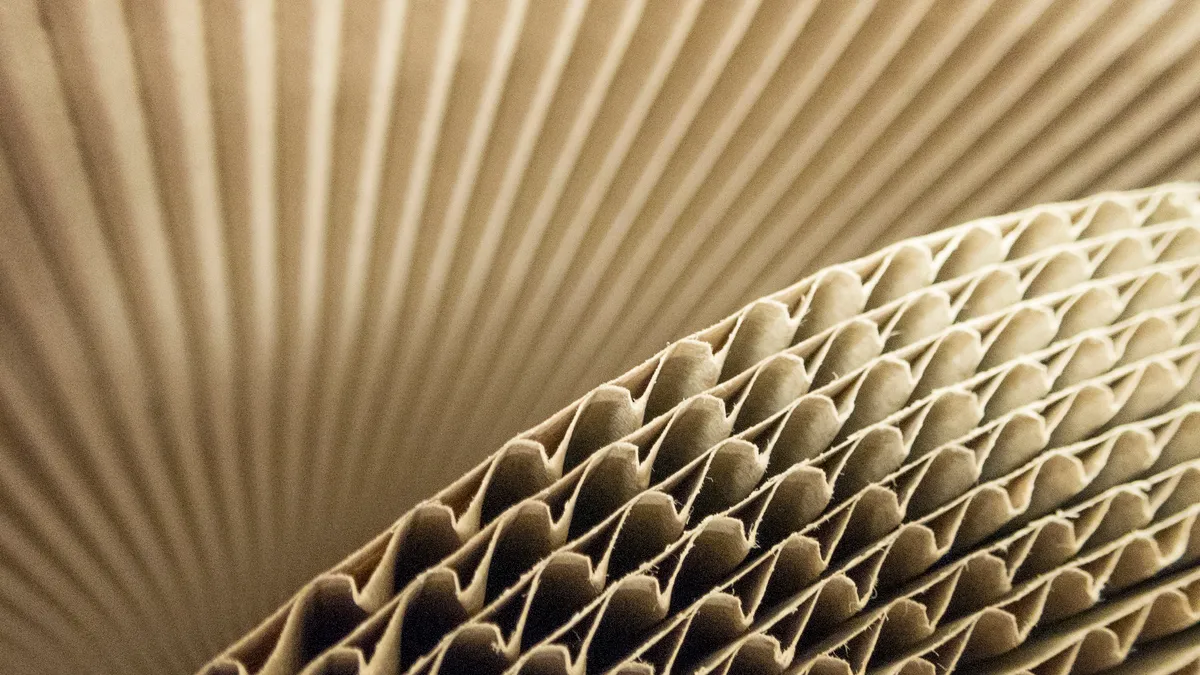

International Paper laid out in its statement to the London Stock Exchange what it calls “compelling strategic and financial rationale” for its proposed business combination, including creating “economies of scale across sourcing, supply chain and administration.” The move aligns with IP’s strategy to enhance its corrugated packaging business in Europe and would “create a truly global leader in sustainable packaging solutions that is well positioned in attractive and growing markets,” it said. IP reports having 27 facilities in Europe, compared with 304 in the United States.

Further, IP said this would enhance innovation and value, especially in the fast-moving consumer goods and e-commerce spaces. And it would “create the opportunity to integrate the mill and box networks, balance the paper positions, and optimise the supply chains, of the respective companies in Europe and the US,” according to the statement.

IP’s proposal makes the field more crowded for a potential DS Smith acquisition, fueling speculation that a bidding war could be brewing.

Earlier this month, Mondi and DS Smith announced that they had reached an agreement on financial terms for a possible all-share offer, extending the firm offer deadline to April 4. At $18.9 billion in sales in 2023, International Paper is larger than Mondi, which charted 2023 revenue of 7.3 billion euros, or about $7.9 billion.

Regardless of which, if any, purchaser wins over DS Smith, such a combination would create a paper packaging giant. Another megamerger also is in the works for Smurfit WestRock, the company anticipated to emerge from Smurfit Kappa’s acquisition of WestRock in an approximately $11.2 billion deal. That transaction is expected to close in early July.

International Paper is no stranger to large M&A. In 2012, it completed its acquisition of Temple-Inland in a $4.5 billion transaction. And in 2018 it made a play for Smurfit Kappa — twice. Smurfit Kappa rejected both proposals and International Paper walked away after attempting for months to woo the company. In a letter dated Dec. 21, 2023, U.K. investment firm and shareholder PrimeStone Capital urged Smurfit Kappa’s board to consider alternatives to the WestRock acquisition, specifically suggesting a combination with IP instead.

A Motley Fool analysis Tuesday noted that the paper and packaging industry is readjusting capacity after a pandemic surge and a subsequent demand slump. That readjustment period creates an environment ripe for consolidation, it explained. Sky News on Tuesday reported a market source speculated that IP’s acquisition proposal could signify its desire “not to be left orphaned by market consolidation.”

Some analysts report that they did not expect this move by International Paper.

“Overall, this announcement comes as a surprise to us given that IP has been focused on rightsizing its portfolio over the last 10-15 years, including organizational streamlining as part of its recent Building a Better IP initiative,” said Michael Roxland, senior paper and packaging analyst at Truist Securities, in a Tuesday commentary to investors. “We were of the mindset that its transformative European growth ambitions had been set aside following its unsuccessful acquisition of Smurfit Kappa,” and instead IP pursued bolt-on acquisitions in Europe to increase its integration rate.

The proposal comes as International Paper prepares for a leadership transition. Last week the company announced a successor to outgoing CEO Mark Sutton. Andrew Silvernail will replace Sutton on May 1.

“It is difficult for us to see how Mr. Silvernail had a say in this decision” to propose a DS Smith acquisition, Roxland said. “In addition, on last week’s introductory call with sell-side analysts, Mr. Silvernail mentioned that while bigger-picture M&A was an option to ensure IP is correctly positioned in the market, he specifically noted that he did not intend to fundamentally rework the company, which this proposed transaction seems to accomplish.”