Dive Brief:

- Mondi and DS Smith announced Thursday they reached an agreement for a possible all-share offer for Mondi to acquire DS Smith. Mondi shareholders would own 54% and DS Smith shareholders would own 46%.

- The companies disclosed Feb. 8 that they were exploring an offer. The deadline for Mondi making a firm offer is now extended until April 4, the companies reported Thursday.

- Mondi would retain CEO Andrew King, as well as its current CFO and board chair, and add three nonexecutive directors from DS Smith to its board.

Dive Insight:

Thursday’s update advances a possible deal that would create a second paper packaging giant, following the combination of Smurfit Kappa and WestRock that is expected to be finalized in July. Mondi has 22,000 employees and DS Smith has 30,000 employees. Each span at least 30 countries and have a U.S. presence.

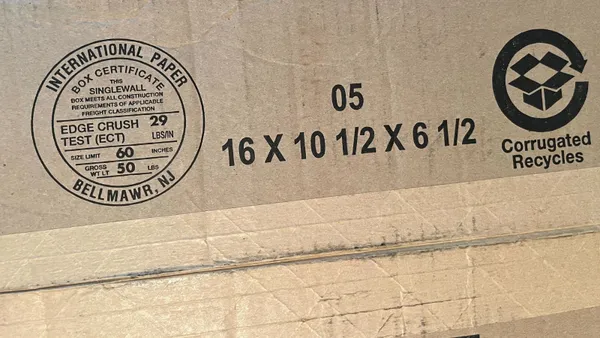

Mondi and DS Smith reiterated in the latest filing that the potential combination is “an exciting opportunity to create a pan-European industry leader in paper-based sustainable packaging solutions,” with opportunities to bring together their “strengths in the corrugated value chain,” including their virgin containerboard mills, converting network and recycled containerboard production sites. Mondi also produces flexible packaging.

The companies are currently working to quantify “synergies” they expect from the combination.

The offer detailed Thursday is based on each company’s closing share price on Feb. 7. The implied value is 373 pence per DS Smith share, representing a 33% premium. Bloomberg valued the deal at 5.1 billion pounds, or about $6.5 billion.

Both companies have recently reported headwinds coming out of 2023.

DS Smith CEO Miles Roberts, who plans to retire soon, said in the company’s fiscal Q3 update on Wednesday that “markets remain challenging.” DS Smith reported that since Nov. 1, corrugated box volumes have been flat, with North America and Eastern Europe seeing growth and Northern Europe reflecting weaker performance. Half-year results the company posted in December showed box volumes were down nearly 5% year-over-year in the first half of the fiscal year, and revenue was down 18%.

Mondi reported its full-year results for 2023 on Feb. 22. Revenue totaled 7.33 billion euros, down from 8.9 billion euros in 2022. Corrugated packaging revenue fell 24%, with earnings hurt by declining selling prices. Mondi says it is the leading virgin containerboard producer in Europe and the largest containerboard producer in “emerging Europe.” Its flexible packaging revenue declined 10%.