The continued e-commerce surge is changing the landscape for packaging, including pushing rightsizing further into the spotlight. While brands have worked to rightsize their product packaging for decades, the on-demand aspect driven by new technologies offers a modern twist.

Generally, the sensor-laden rightsizing machines detect the product's — or multiproduct shipment's — size and run that data through algorithms to determine what box would most closely fit the contents. Certain models are 2D systems, which use partially constructed boxes that they cut down to height and crease for folding. Others are 3D systems, which run corrugated sheets that are formed on multiple dimensions.

"We dimension on all three: length, width, height," said Rod Gallaway, CEO at packaging and equipment supplier Packsize. "It could be one time we're going to build a 30 by 20 by 30 box, and the very next box that comes out of that machine could be four by four by four.”

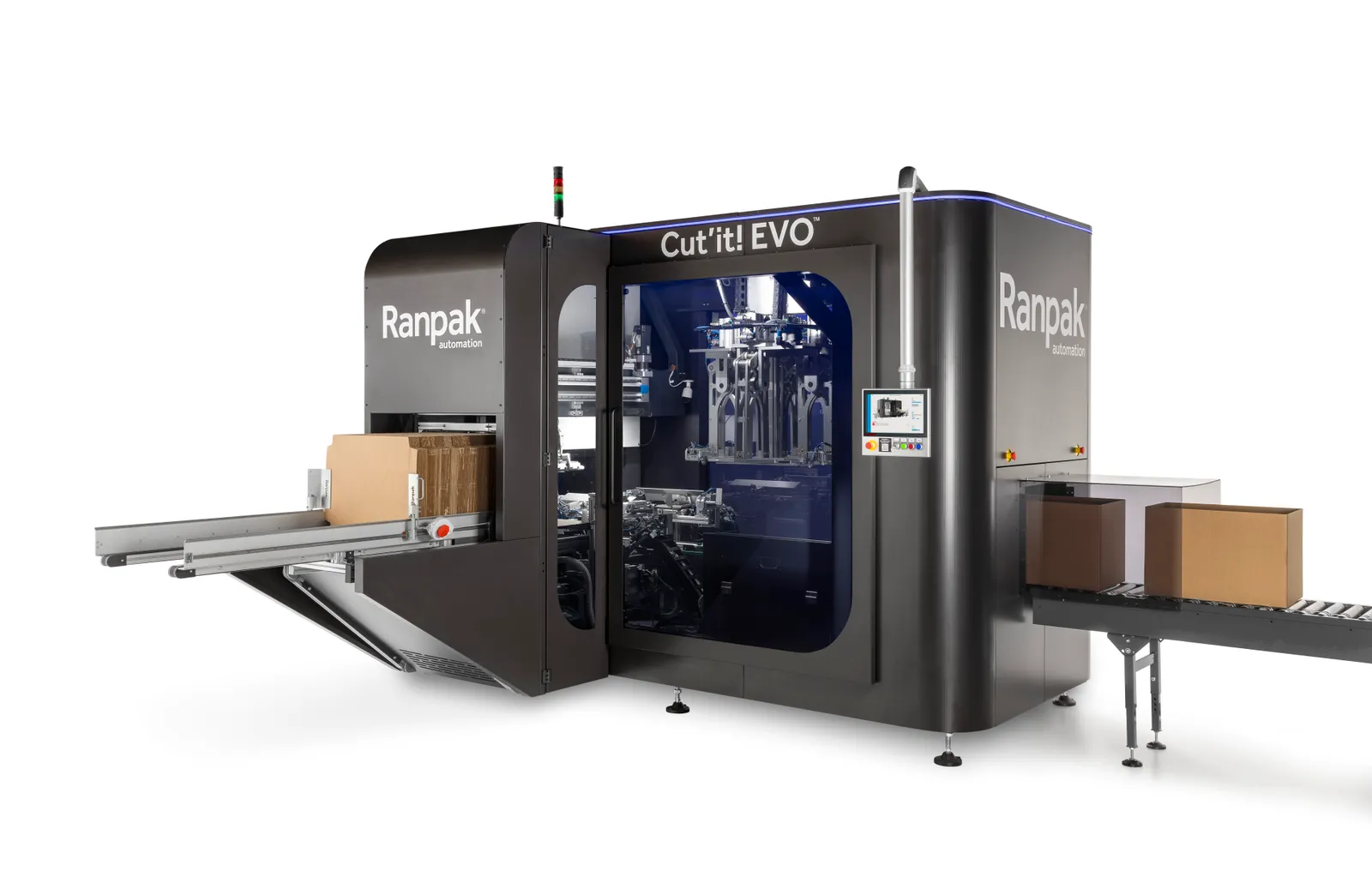

The automation speeds fulfillment and cuts labor costs, especially in the tight market, according to Bryan Boatner, global managing director of automation at packaging and equipment supplier Ranpak.

"They're an innovative solution. They do enable you to create a box roughly around the size of the items that need to be packed," he said. "The market is kind of starving for this type of application."

The product variability within e-commerce fulfillment, in which numerous types of products typically share the same secondary packaging lines, makes the sector a prime candidate for on-demand rightsizing automation. Online retail giants Amazon and Walmart both touted rightsizing initiatives this year, largely as a sustainability and waste reduction move. Walmart noted it would make technology investments to enable the practice in about half of its fulfillment network.

This year, Amazon detailed its principal focus to eliminate secondary packaging altogether, after which it strives to rightsize outer packaging and switch from plastic to fiber substrates. Those themes are evident at its Euclid, Ohio, fulfillment center, which this fall became the company's first to convert to only using paper packaging. Achieving the fiber-only focus required new technology installations, including a machine to make rightsized boxes on demand.

"There's more demand for it in general across all product lines ... but e-commerce has been where the most demand is coming today," Gallaway said. "Most of the adoption has been driven in the last five years, and particularly in the last three years."

Change drivers

Looking to sustainability, on-demand rightsized, or variable, packaging "actually makes a lot of sense,” said Brent Lindberg, founder of packaging design firm Fuseneo, because “you can use a lot less material" not just for a box itself but also for void fill material and dunnage. The practice also can reduce emissions, specifically during transport: Increasing box density in trucks ups the amount of shipments per vehicle, thus resulting in fewer vehicles on the road.

"The [shipping] model today isn't sustainable without rightsized packaging," Gallaway said. "We know that 100% of the trucks running around have 40% air in them because the boxes inside are too big ... We've demonstrated over and over that we can improve density by as much as 40%."

Rightsizing also is a cost and economic play, both from a shipment density and material reduction standpoint.

"A lot of brands over the past several years have been rationed space and restricted in how much they can ship," Lindberg said. "They're looking to get the most [product] out the door, make the most space on the truck and get out the most deliveries as possible."

Brands and retailers also are starting to use the technology. They view rightsizing as a way to give consumers what they desire in areas such as sustainability and customization, Gallaway said. He described a previous job working at Staples in which he sought out Packsize's services.

"What we were looking for was how to improve Staples' customer experience with unboxing," he said. "Everybody is trying to win the consumer. And one way to do that is giving them a great unboxing experience."

Rightsizing complements the growing customization and personalization trend, he said, and allows businesses of all sizes to distinguish themselves from competitors to more effectively reach consumers. Packsize's customers are "competing for the exact same consumers as Amazon and Walmart,” said Gallaway, “and where there's personalization, it makes a difference.”

Beyond the box

While boxes currently get the lion's share of attention when it comes to on-demand rightsizing, some businesses also employ technologies designed for flexible mediums.

"On the flexibles side, you have variable-length bags — whether those are paper or poly. You just have a certain fixed width, and the length can vary by the product," Lindberg said. "The investment of a proprietary machine for variable-size packaging is not cheap, and then you're really stuck to a specific material format ... We see easier adoption on the non-rigid side."

Sources report not only working to expand their customer base, but also efforts to add new system capabilities. Areas of opportunity could be for box decoration and additional cloud-based or artificial intelligence functions. This year Packsize added cloud computing capabilities.

New technology adoption often cools over time as greater market penetration occurs, and eventually that will likely happen to variable packaging investments as well. “The market already has experienced significant growth and I think it's going to start to plateau at some point," Lindberg said.

But in the short to medium term, uptake is predicted to continue at its current — or even an increased — pace to help advance the evolving e-commerce sector.

"There's been a lot of appetite for more investment in automation based on the benefits that have been realized from goods to person. I've seen that shift to end-of-line packaging automation," Boatner said.