Bio-based materials producer Origin Materials, whose components can be used in packaging, has undergone a lot of change in 2023, with the latest being Monday’s announcement that Matt Plavan will take over as CFO. He’ll assume the position on Oct. 30, following the departure this summer of former CFO Nate Whaley.

Plavan most recently served as CEO at IngredientWerks, a plant-based protein ingredient producer that spun off from Agrivida. Previously, he was CFO at Arcadia Biosciences, where he secured multiple rounds of equity financing to mature the business, according to Monday’s announcement. Plavan also held prior positions at Cesca Therapeutics, McKesson and Ernst & Young.

“Matt has broad, highly relevant experience within publicly traded companies introducing disruptive solutions into well-established industries, successfully setting and managing financial performance expectations with key stakeholders through multiple stages of growth,” said Rich Riley, co-CEO of Origin Materials, in the announcement.

Plavan will replace Pam Haley, who was announced as the interim CFO on Aug. 30 and assumed the position Sept. 1. Haley took over for Whaley, whose departure was announced in June.

A filing with the Securities and Exchange Commission said Whaley resigned June 13 and the departure “was not due to any disagreement with the Company or any matter relating to the Company’s operations, policies, or practices.” It said that Whaley would remain in an advisory role through the end of this year to aid in searching for and onboarding his successor.

Scope change

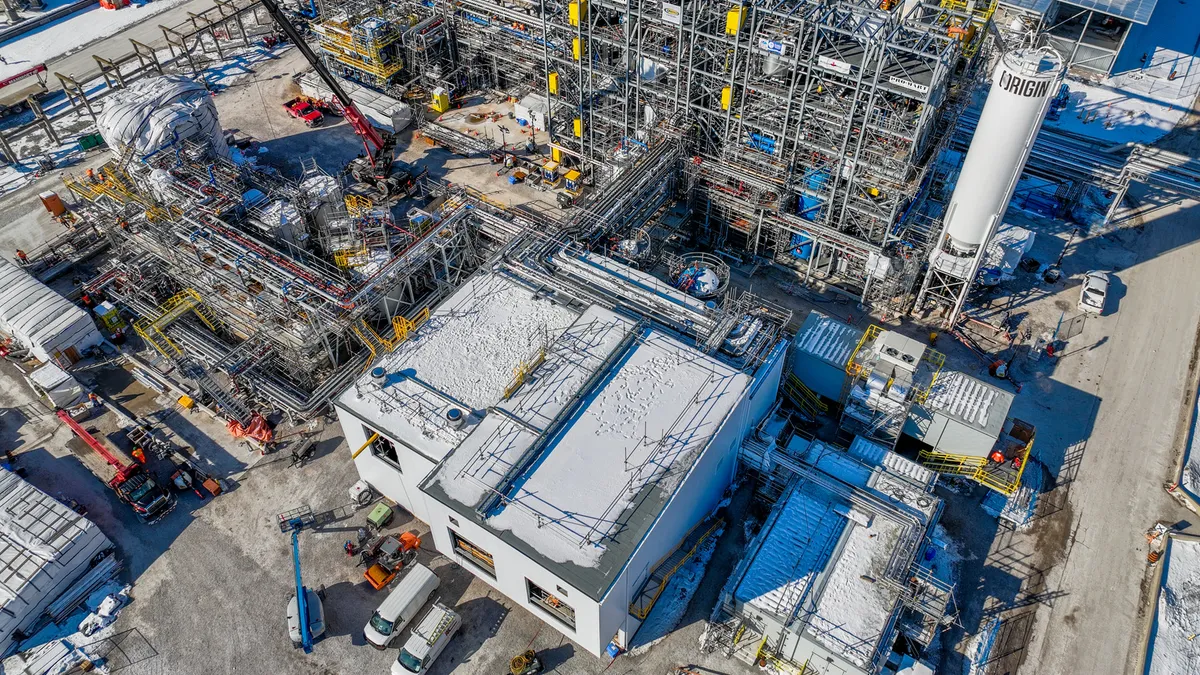

Weeks after Origin announced Whaley’s upcoming departure, it announced that operations began at its first manufacturing facility, Origin 1. The Ontario, Canada, plant transforms non-food biomass, such as pulp mill residuals, into chloromethyl furfural (CMF), an intermediate component of PET used for plastic packaging.

The bio-based material is intended to be a more sustainable alternative to fossil fuel-derived polymers. Co-CEO John Bissell indicated the plant should reach full capacity in six to 12 months.

This year, California-based Origin also announced that it created a cap for plastic bottles made entirely of PET, which it said allows for monomaterial, more recyclable bottles; partnered with Terphane to produce biopolymer films; and partnered with Husky Technologies to commercialize PET that incorporates furandicarboxylic acid (FDCA).

Last year, Origin began constructing its second facility, Origin 2, in Geismar, Louisiana. That plant was designed to be larger than the initial facility in Canada and capable of processing 1 million tons of biomass annually, with an anticipated startup in 2025. Similar to Origin 1, it would use patented technology to produce “carbon-negative materials” for making PET used in packaging other products.

“Origin Materials’ decision to locate its largest plant-based plastics operation here speaks to our region’s continued advantages for workforce and supply chain, even as technologies change for the future,” said Baton Rouge Area Chamber President and CEO Adam Knapp in a statement last year.

But on Aug. 9, the company announced changes to the Origin 2 plan in a press release and SEC filing. The company said it would switch the intermediate product focus at Origin 2 from para-xylene (PX) to FDCA, citing positive and negative “profound market shifts” since the company went public in 2021.

Origin said it had intended for a third planned plant to eventually make FDCA, but progress on product development and commercialization — combined with higher-than-anticipated demand — prompted it to pull forward FDCA production to instead occur at Origin 2. During an interview with Packaging Dive in July, Bissell noted the company’s desire to commercially produce FDCA at some point, saying polymers made from the material are more cost effective to make, have higher barrier properties than conventional PET or polyester and are recyclable.

“FDCA is something we’ve always had on the slate as an interesting product, but we’ve gotten a lot more feedback from customers in the last couple of years that they want it sooner rather than later. That affects our plans,” he said at the time.

One of the main “market shifts” the company cited for the Origin 2 project update is a higher cost capital environment. The company previously expected that construction could be complete by mid-2025, with capital costs of $1.07 billion. Phase 1, with a capital budget up to $400 million, is now anticipated for late 2026 or 2027, and the phase 2 startup, with a capital budget up to $1.2 billion, is predicted for 2028.

Origin’s notable 2023 activities

-

June 16

Announcement of CFO Nate Whaley’s departure after Sept. 1.

-

June 27

Announcement of startup of first commercial plant, Origin 1.

-

Aug. 7

Announcement of creation of 100% PET bottle cap.

-

Aug. 9

Document filed with SEC stating changes to scope of Origin 2 project.

-

Aug. 25

Plaintiff files a class action lawsuit against Origin and executives claiming securities fraud due to the scope changes.

-

Aug. 30

Pam Haley named interim CFO, effective Sept. 1.

-

Oct. 2

Matt Plavan named new CFO, effective Oct. 30.

Lawsuit emerges

On Aug. 25, shareholder Antonio Soto filed a class action lawsuit against Origin Materials and certain executives — Riley, Bissell and Whaley — accusing them of securities fraud that resulted in damage to plaintiffs. The lawsuit alleges the parties made false or misleading statements — mainly related to Origin 2 — that misguided investors who purchased shares from Feb. 23 to Aug. 9, 2023, and lost money.

The suit claims, among other things, that Origin executives failed to disclose that “demand for PX had dropped such that it would not be the production focus of Origin 2,” the second plant would not be constructed at the scale first identified and the Aug. 9 announcement resulted in Origin’s per-share stock price falling the next day by about two-thirds.

The lawsuit alleges the individual executives had the ability to control what was disclosed in materials such as press releases and SEC filings yet concealed information that could cause an adverse public reaction. It also claims the company has a history of not being profitable and executives made false or misleading claims that were overly positive about Origin’s business prospects, which artificially inflated its stock price. The plaintiff seeks compensation for damages he and other investors sustained due to Origin’s “wrongdoing.”

Origin and Soto’s attorneys did not respond to requests for comment prior to this article’s publication.