The M&A environment for packaging companies has strengthened in 2023 after financing and destocking affected deals earlier in the year. Heading into 2024, experts believe the landscape for deals is poised to improve further.

“Right now, we have stabilization in the debt markets, deep availability of private equity and strategics turning towards growth mode,” said Will Frame, CEO of Deloitte Corporate Finance. “So after certainly a period of bumpiness through this calendar year, we have conditions where the buyers of the market are really interested in deploying capital into sectors like packaging.”

While interest rates remain high, Frame said that the ability to raise financing has improved and “debt providers are starting to become a little more aggressive.”

Multiple publicly traded packaging companies have also announced deals of their own this year. Most notably, Smurfit Kappa’s pending purchase of WestRock could create the biggest publicly traded packaging company in the world.

Michael Roxland, senior paper and packaging analyst at Truist Securities, said this year’s economic backdrop “was certainly a factor” as Smurfit had the opportunity to buy “a company whose key business was at the trough of a cycle."

Roxland said the deal would give Smurfit immediate scale in the U.S., at a time when it’s winding down a capital investment and cost reduction program — lessons from which could be applied to WestRock’s assets. Recent announcements by companies in the space about 2024 price increases makes the economics even more favorable due to the potential for increased profitability.

"If this goes through then Smurfit Kappa's timing looks good because they [reached a deal] when prices were lower,” he said.

Driving factors

The combination of higher interest rates and longer-than-expected destocking effects may have also limited some M&A opportunities earlier in 2023 because it was harder to find growing companies.

"Flat became the new up. Down businesses aren't trading,” said Scott Daspin, director of investment banking at Triad Securities. Daspin, who advises on smaller deals, gave one example of how the higher rate environment is squeezing certain businesses.

"The customers of these packaging firms are continuously asking to extend credit. So I've seen a lengthening process of accounts payable,” he said, noting that in some cases, "packaging clients have turned away business because they couldn't fund the order."

Such factors could potentially depress valuations. There have also been examples this year of packaging companies filing for bankruptcy. That said, sources were not aware of any companies selling for this particular reason. Instead, the causes for selling are evergreen, such as succession planning, a need for liquidity or a desire to scale up with private equity investment.

Daspin said seller motivations are always case by case. Sometimes, "there are owners that actually don't need the liquidity event" and can retain a stake that helps the next generation take over, or in some cases they need to cash out to retire. In other cases, he said, "there are owners that will never sell."

If private equity gets involved, those investors tend to prefer that an owner stays with the business due to their customer relationships. Though this may be different if the private equity deal is part of a broader platform or roll-up strategy.

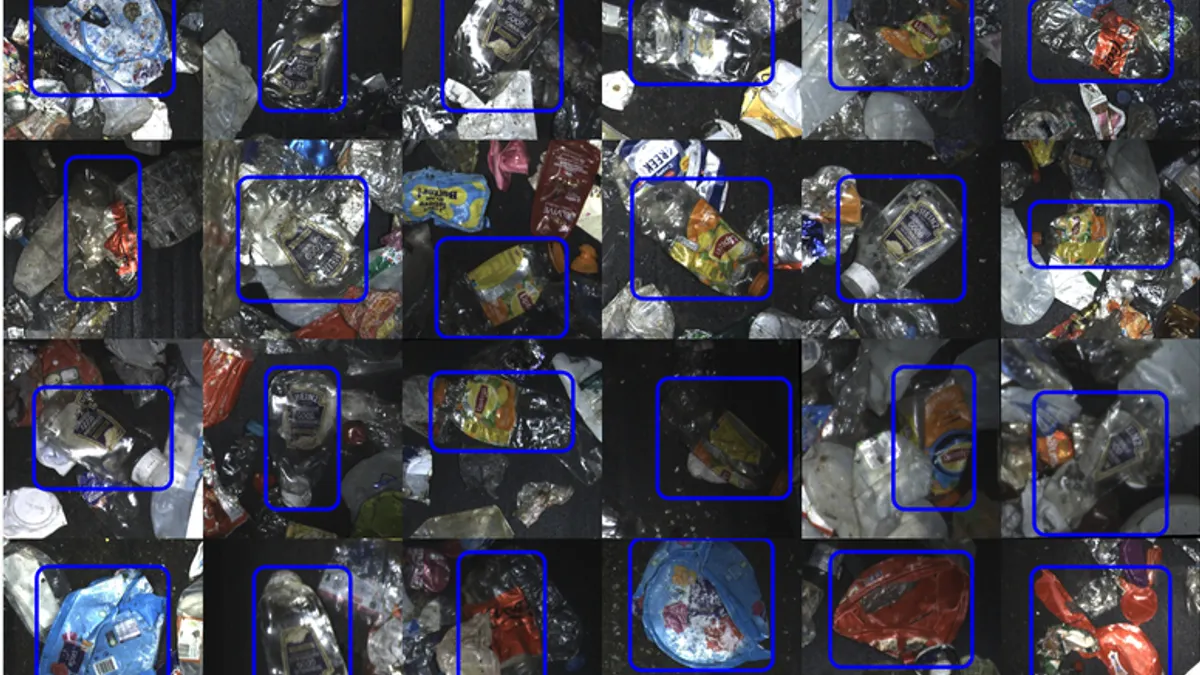

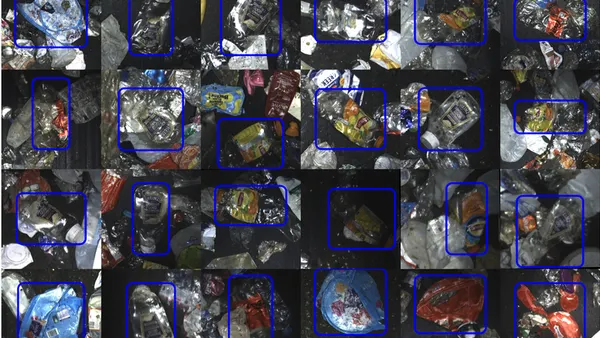

Frame, who has a long background advising on packaging M&A deals, said the sector’s resilience is attractive to investors, with fiber attracting particular interest recently. Subsets such as labels and folding cartons have also gotten more attention, as detailed in Deloitte’s latest quarterly M&A trend report.

Separately, the industry’s major public companies have been looking to streamline their operations through possible divestitures.

“Activists and others are looking at trying to simplify businesses,” said Roxland. “I think companies themselves are looking at, particularly if they have high leverage, ways to monetize those businesses.”

Examples include Ball’s pending sale of its aerospace business and Berry Global’s consideration of selling its Health, Hygiene & Specialties division. While Roxland said Berry viewed this segment as a growth area when it purchased Avintiv for an estimated $2.45 billion in 2015, “it has not worked out as planned.”

Other examples include investor Carl Icahn pushing Crown to divest certain assets last year, as reported by The Wall Street Journal.

Looking ahead

Moving into 2024, all eyes are on what the Federal Reserve does with interest rates but packaging M&A activity looks ripe to continue and possibly see a return to more predictable patterns.

“As we emerge from destocking and the lingering impacts of the pandemic and supply chain disruption there's an element of normalizing that points to something closer to a regular M&A environment,” said Frame.

"My gut feeling is there's going to be a busy first quarter” for M&A, said Daspin, in part because some people have been waiting to close out a full year of earnings in 2023 that may be better or equal to prior years before making decisions.

"I think we're going to continue to see some layoffs and I do believe that the economy is going to slow down a little bit, and I think sellers might get some cold feet midyear,” he said, citing broader economic analysis, while noting that sectors such as food and healthcare packaging could be more resilient.

In terms of larger deals, Roxland said he didn’t anticipate the sector had room for much more consolidation among the biggest paper companies. At the small or medium scale, Frame said there is plenty more runway for further deals.

He noted that capital-intensive substrates such as aluminum or glass have a high barrier to entry, but this is less of a factor for converters of paper and plastic.

“There's a cycle of innovation, growth and consolidation,” said Frame. “I think it's a permanent feature of packaging.”