The tide may be turning for the volume of mergers and acquisitions in the packaging space. Although 2024 was a lighter year compared with the prior few, analysts say they largely expect the pace to pick up in 2025.

“After a tough year in '24, I think there's good reason to say '25 will be better than a tough year,” said Will Frame, CEO of Deloitte Corporate Finance. “Some folks are even more optimistic than that.”

The COVID-19 pandemic that began nearly five years ago ushered in a period of economic turbulence. Uneven economic conditions are a “really toxic blend for the sort of optimism and growth that really tends to underpin M&A activity,” Frame explained. The recent lower demand environment for packaging aligns with the depressed levels of M&A. But the destocking period “must be behind us. It went on into '24 way longer than anyone could have expected,” he said.

2025 could prove to be the year for some level of renormalization in M&A volumes as volatile supply chain dynamics and packaging economics show signs of evening out. President Donald Trump’s administration is also expected to have an influence. And private equity could come out of its recent lull, perhaps for more of the megadeals that have cropped up lately.

“Are we going to have more of those big acquisitions? It's tough to say,” said Michael Roxland, senior paper and packaging analyst at Truist Securities, speaking solely in regards to publicly traded companies. “But I think what we might see is portfolio pruning after the large acquisitions. ... I think there could be some type of plant rationalizations, plant closures, business line rationalizations.”

Finding a niche

Packaging sectors poised for growth correlate with those ripe for consolidation. And the greatest consolidation opportunities in 2025 might exist within niche areas rather than broader categories.

Broad sectors like glass and metal already are rather consolidated, Frame said. But there should be decent levels of activity “in areas like flexible packaging — including plastics and labels — after a wave of consolidation in 2022-23 and a slower 2024,” he said.

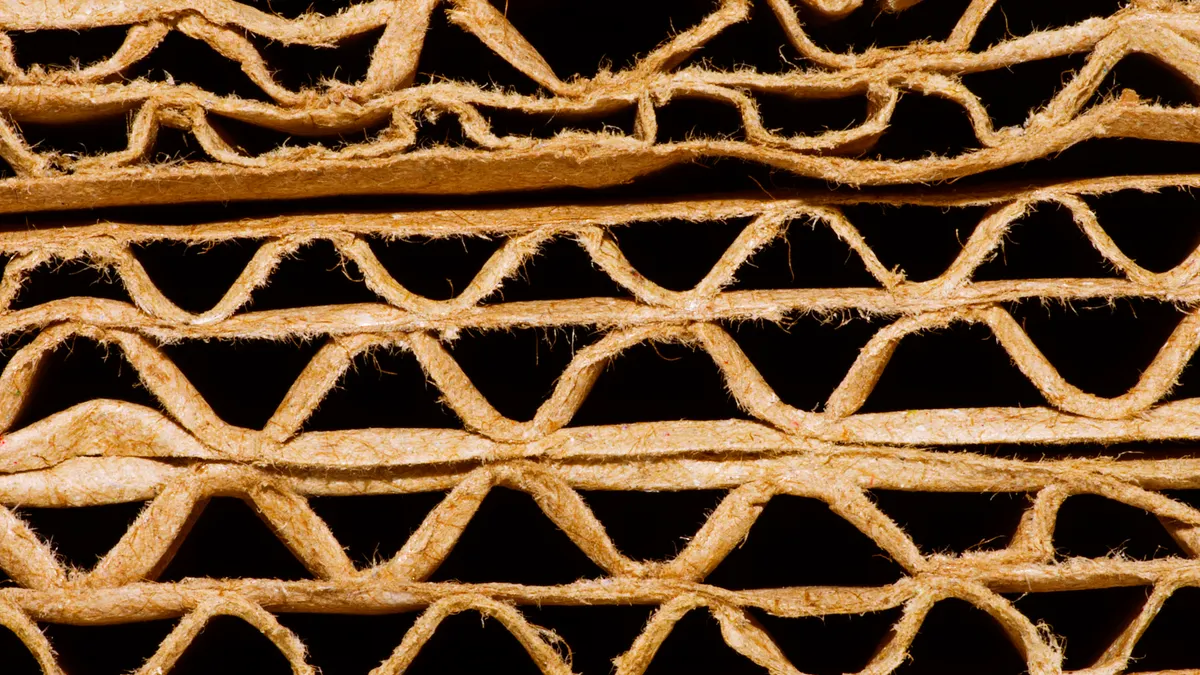

Molded fiber has experienced a steep growth curve over the past decade, and more expansion is expected through 2030, according to data from The Freedonia Group. That could tee up the sector for more M&A this year and in the medium-term.

“There is a lot of growth and innovation in molded fiber-based packaging and there is still room for consolidation in that area,” said Jennifer Christ, manager of consumer and commercial goods research at The Freedonia Group.

Momentum for brands adopting more sustainable packaging, such as by switching away from plastics, also influences M&A in certain markets, analysts say. Fiber-based packaging substrates, especially molded fiber, have “some wind in their sails. We expect that to continue,” Frame said.

Reusable packaging — whether plastic, metal or glass — is another space primed for growth due to its sustainability attributes, Frame said. Freedonia is also keeping its eye on the smart packaging, or “active and intelligent,” segment for additional M&A activity, in light of the connection to added sustainability.

“Given increasing interest in innovative solutions to sustainability and functionality challenges, packaging firms might be looking to acquire technology rather than deal with the extended timeline of developing it internally,” Christ said.

Still going big?

Many of 2024’s deals were notably large. Megamergers will continue — or perhaps even intensify — this year, analysts project.

Smurfit Kappa kicked off a wave of multibillion-dollar transactions in late 2023 when it announced it would acquire WestRock, a deal that closed in July 2024 and created the world’s largest packaging company. Numerous other large deals were announced in 2024, and some were finalized, such as Sonoco's $3.8 billion acquisition of metal packaging company Eviosys. Others, like Novolex’s purchase of Pactiv Evergreen for $6.7 billion, are still in progress.

Many of these megadeals reach across borders, including Tennessee-based International Paper's acquisition of London-based DS Smith, slated to close Jan. 31, and Switzerland-based Amcor's in-progress $8.4 billion acquisition of Indiana-based Berry Global.

Analysts are still trying to determine if the wave of large deals could influence how both U.S. and foreign regulators examine market concentration and deal approval. The Smurfit Westrock deal didn't require divestitures, nor did Sonoco’s Eviosys transaction. But at least one subsequent deal already met a different fate: The European Commission announced in January that International Paper must divest five plants for approval of its DS Smith acquisition, which is contrary to most observers’ prior expectations for that transaction to sail through regulatory reviews largely untouched.

Some large deals haven't solely entailed entire companies; rather, they involved divesting certain business segments or exiting joint ventures.

Ball completed the $5.6 billion sale of its aerospace business in 2024 to become a pure-play packaging company. Similarly, Clearwater Paper completed the $1.06 billion sale of its tissue business to Sofidel to focus solely on paperboard. In December, Veritiv completed its acquisition of Orora Packaging Solutions, a U.S.-based business of Australia-based Orora, and Amcor sold its 50% interest in joint venture Bericap North America. Toppan Holdings plans to acquire Sonoco's Thermoformed and Flexibles Packaging business for $1.8 billion in a deal expected to close during the first half of this year.

These types of partial transactions likely will continue at least through this year, according to analysts. International Paper’s autumn announcement that it would likely sell its global cellulose fibers business puts it at the top of the watch list.

Another company to watch — either for buying business units or whole companies — is Brazilian pulp producer Suzano, which entered the U.S. packaging market last year with its purchase of two Pactiv Evergreen mills. The company also attempted to enter the mix last year with a failed play for International Paper that wasn't on many analysts' radars. Rumors circulated in the waning days of 2024 that the company might make a move for Clearwater Paper in 2025, although Suzano released a statement in December indicating that no formal agreement had been reached.

Private equity still plays a role in sizable packaging M&A deals, such as Glatfelter last year merging with Berry Global's spun-off Health, Hygiene and Specialties Global Nonwovens and Films business to form a new company, Magnera. Apollo is the majority owner of Novolex, which is acquiring Pactiv Evergreen.

But PE firms’ sales of assets acquired in the 2015 to 2023 time period — which is a “large population,” according to Frame — have been relatively slow the last couple years. This aligns with a broader trend across industries of PE sitting on a chunk of money yet to be deployed. But that could shift soon.

“It can't stay that way forever,” Frame said. As conditions improve, “you'd expect to see some decent population of that group start to come to the market as well.”

Despite some peaks and valleys, packaging typically is a steadily performing industry, and “that's why private equity has been involved in this space over time,” Roxland said. “Private equity is around, they're evaluating things and they're ... trying to find the right opportunities.”

Federal friends or foes?

President Trump's policies stand to influence M&A activity. But merely days into his presidency, analysts hesitate to offer firm predictions about how or to what extent his policies will alter transactions and the overall dealmaking environment.

Frame noted that changes in administrations, generally speaking, often are accompanied by a sense of optimism. Meantime, economic data — including employment statistics — has “been stubbornly strong,” he said, despite holdbacks like sticky inflation and high interest rates. Those strong data points also tend to be positive signals for M&A activity.

The public generally perceives Trump as pro-business. And pro-business leadership often fuels investments, Roxland noted. “We'll just have to see what he does with respect to how that pans out for the key industries ... and what that ultimately means for regulations as well,” he said.

Without directly predicting whether the Trump administration might affect the pace of M&A, Gabe Hajde, senior analyst, packaging and paper equity research, at Wells Fargo Corporate & Investment Banking, noted in a discussion in November that the public historically has perceived that “a Republican regime typically is more accommodative to M&A,” in terms of its regulatory approach.

“The new administration has not been shy about signaling that they will be less aggressive in regulations and likely antitrust enforcement,” Christ said. “I expect that larger acquisitions will receive less scrutiny, perhaps incentivizing deals that might have been more onerous to complete before.”

The upcoming impact from Trump's promised tariffs, at least some of which are set to begin in February, is also a wild card.

“Companies might be looking for ways to strengthen their supply chains given the threats of tariffs and the need to secure sought-after paper stocks and recycled content,” Christ said. “Whether it’s via acquisitions or joint ventures or other strategic agreements, companies will be watching forestry and paper processing options as well as deals with waste processing.”

Another factor will be what the Federal Reserve decides to do with interest rates throughout 2025. Lower rates could accelerate M&A, Roxland explained.

Analysts say to expect the unexpected, both for elements that could influence M&A in 2025 and the companies involved in deal announcements. Regardless of where the deals occur, “My sense tells me it’s going to be a pretty active year,” Roxland said.