Recyclers took in more postconsumer plastic for processing in 2021 than in 2020, a new report shows. This marks a rebound in volumes from an early pandemic dip.

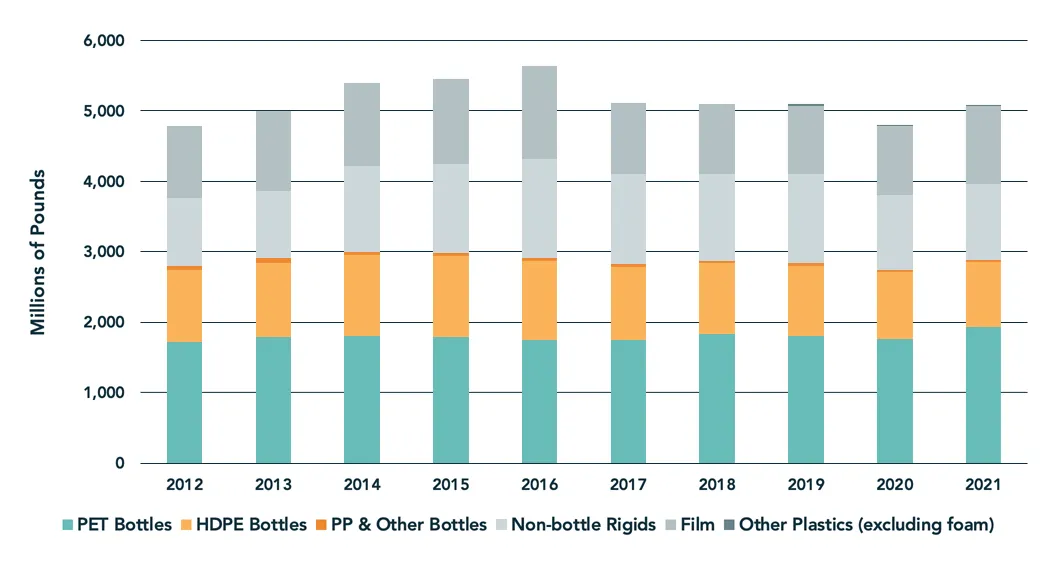

Recyclers acquired nearly 5.1 billion pounds of plastic overall in 2021, which is more than 280 million pounds higher than in 2020, according to the report. Stina prepared the report, which was released by the Association of Plastic Recyclers, the Institute of Scrap Recycling Industries and the U.S. Plastics Pact, with partial funding from The Recycling Partnership. In 2020, a decline of 290 million pounds occurred, but the new numbers show a return to 2019 levels.

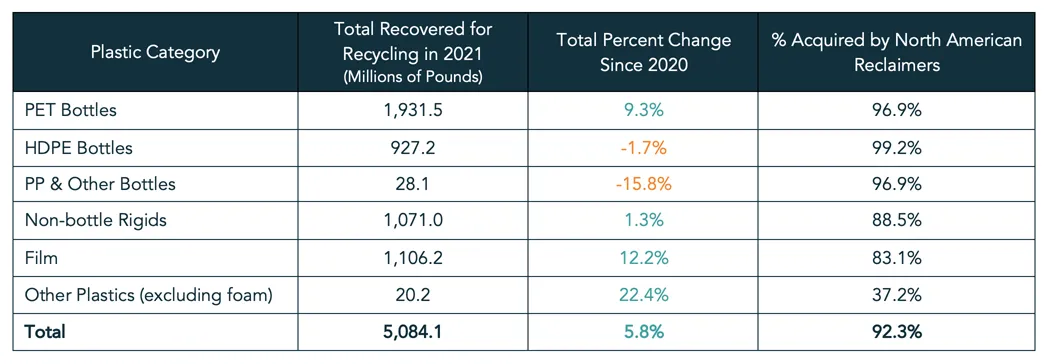

All major categories examined — bottles, non-bottle rigids, film and other plastics (excluding foam) — experienced an increase in total pounds, although the HDPE bottles and PP sub-categories experienced declines.

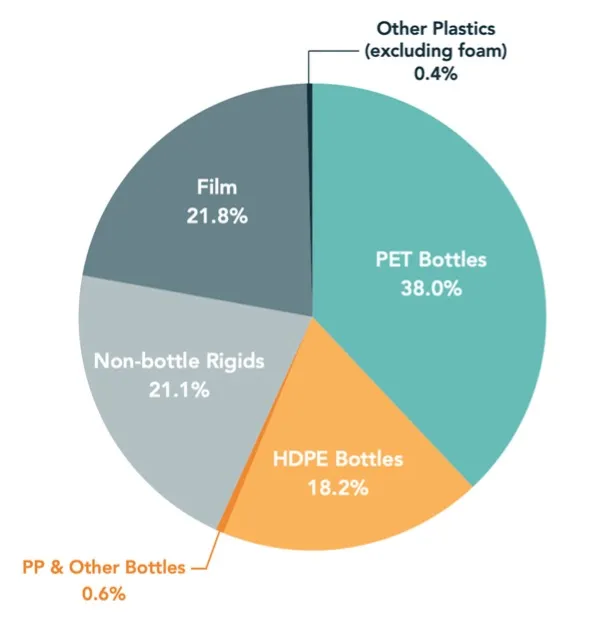

Bottles continued to reign as the category with the highest recovery rate, 56.8%. That category is largely comprised of PET bottles, 38%, followed by HDPE bottles at 18.2% and PP and other bottles at 0.6%. Film (21.8%) moved past non-bottle rigids (21.1%) to become the second largest category.

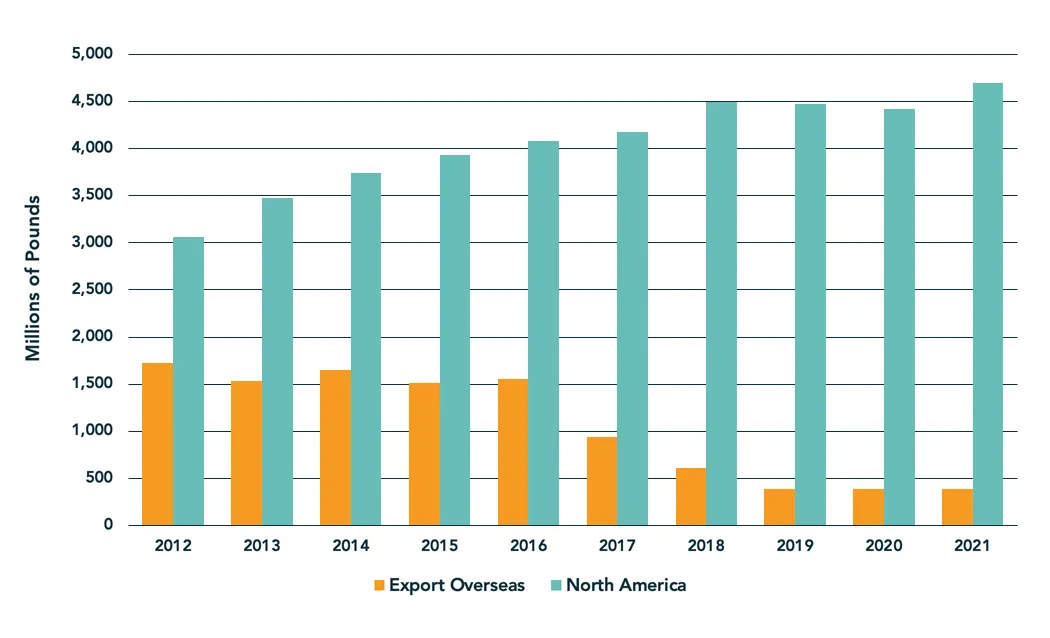

Most of the plastics recovered for recycling in the U.S. are staying domestic instead of being exported, according to the report. Nearly 4.3 billion pounds, or 84.3%, was recycled in the U.S., and 92.3% stayed in North America. The remaining 391 million pounds, 7.7%, was exported overseas.

Exports have remained relatively steady since 2019, following notable drops in 2017 onward that coincide with when China announced its National Sword policy.

Beyond the numbers

The report provides data, but it does not detail end markets, material values or draw conclusions about causation for the plastic recycling trends. For example, it does not speculate about why film recovery surpassed non-bottle rigids or why overall volumes increased. However, anecdotal evidence would suggest that a return to pre-pandemic normalcy played a role.

Recycling difficulties arose during the early days of the pandemic that affected labor as workers fell ill and as some communities halted recycling collection; fears — which ended up being unfounded — that virus-contaminated materials could infect collection workers and sorters also contributed to program pauses. Similarly, beverage container redemption rates dropped as some states suspended their programs and some businesses and communities reverted to single-use packaging and food service ware that could be disposed as opposed to recycled. The situation influenced supply, demand and pricing for various packaging substrates, including metals and plastics.

While the report sponsors lauded the industry’s efforts to overcome pandemic reductions, they also noted the continued work needed to push collection and recycling even further.

“If we expect to achieve true recyclability, we need high demand for recycled plastics. Achieving true recyclability, as well as using higher percentages of PCR requires significantly greater tonnages of recycled plastics,” U.S. Plastics Pact Executive Director Emily Tipaldo said in a statement.

The report’s sponsors said that extended producer responsibility is one method that could benefit supply and demand dynamics.

“In order to see bigger increases, there’s a need for systematic change led by public policy to drive collection, improve sortation and stabilize demand for recycled resins,” the Association of Plastic Recyclers President and CEO Steve Alexander said in a statement. Alexander added that APR supports the EPR legislation and postconsumer recycled content requirements that several states have enacted. “APR also supports a national bottle bill and other federal legislation that can drive change.”