Brands have released a flurry of products recently that sport new or redesigned fiber packaging to move the needle toward their sustainability targets and meet consumer demand, according to speakers at the Paper and Plastics Recycling Conference in Chicago last week. But despite the achievements, some brands aren’t on track to meet certain 2025 or 2030 sustainability goals.

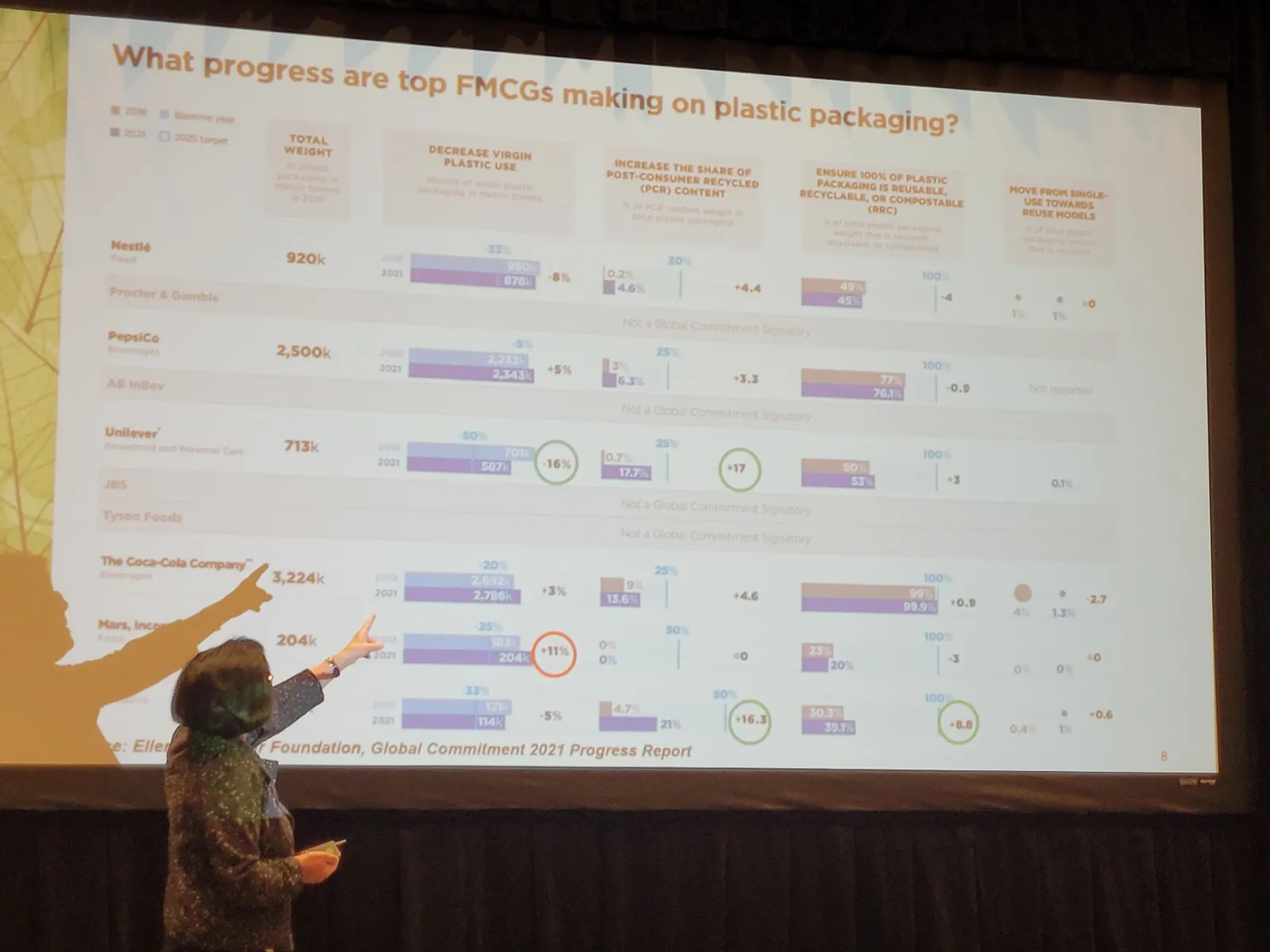

“Obviously, there’s been a big increase in sustainability” in packaging, said Susan Cornish, president of consulting firm Insight + Action. She noted that from 2018-2020, the top five CPG companies — Nestlé, PepsiCo, Unilever, The Coca-Cola Company and Mars — released formal sustainability goals, such as decreasing virgin plastic use, increasing postconsumer recycled content and ensuring all packaging is reusable, recyclable or compostable.

They’re working toward these goals in large part to meet demand from consumers for sustainable products, Cornish said. “Consumers [are] not making the products. They have to buy the products and they hope that companies will take responsibility for making these changes,” she said. Cornish cited surveys suggesting consumers view paper as more “eco-friendly” and would prefer paper packaging over plastic even if it costs more, in addition to data suggesting sustainability claims on packaging lead to higher sales.

Prior to “about three years ago when we started tracking this, there are a huge number of [these] products out now, Cornish said.

CPG companies are increasingly moving away from substrates such as plastic or glass and toward paper packaging. Plastic replacement for food-grade packaging is expected to significantly increase demand for paperboard over the next five years, said Cornish, citing data from pulp and paper business intelligence company Fisher International.

Fisher predicts a 12 million ton increase in global paperboard capacity over the next four years, and it estimates that replacing 5% of plastic packaging with paper would consume 1.5 million tons of paper. Yet, “there are some logistical questions” about how quickly the transition can occur, Cornish said.

Bill Moore, president at consulting firm Moore & Associates, corroborated that change doesn’t tend to happen quickly. “One of the things we've learned in the packaging space is there's a real time lag. We’re just starting to see a lot of things that have been in the works for two to four years come to the market,” he said.

Cornish pointed to numerous examples of brands switching to fiber: Carlsberg beer piloted fiber bottles, Kraft Heinz partnered with Pulpex to develop a paper-based ketchup bottle, Pringles trialed all-paper chip tubes in Europe, Quilted Northern switched to paper outer packaging for toilet paper and Nestlé worked to develop paper-based Nespresso coffee pods. As far as compostable and biodegradable packaging innovations, she noted Notpla’s work to develop seaweed-based sachets.

Although more fiber packaging is entering the market, many products inherently have barriers to recyclability. For example, fiber food packaging tends to have coatings such as polyethylene to prevent grease and moisture from degrading the paper.

Some packaging companies therefore are developing innovations such as peelable layers so consumers can separate the fiber portion from the coating and recycle the paper components. But that raises questions about how many actions consumers are willing to take to recycle a piece of packaging, especially at a time when confusion about recycling is prevalent.

“Will the consumer separate the fiber from the liner?” Moore said, adding that this type of liner is “fraught with problems all the way through the system,” including at the MRF level.

Still, the influx of new packaging shows that “brands certainly are taking their goals seriously and are making changes,” Cornish said. However, “there's been a lot of discussion about whether companies are going to make their goals by 2025 or 2030.”

Unilever has done relatively well with virgin plastic reduction compared to the other large CPG companies, based on The Ellen MacArthur Foundation’s 2021 global commitment progress report, Cornish said. Global commitment participants added a new goal in 2021 to reduce virgin plastic use by 20% in absolute terms by 2025 compared to 2018. Unilever posted the only double-digit decrease in virgin plastic use, 16%, whereas Mars’ use went up 11%. Unilever also showed the most progress at increasing postconsumer recycled content in packaging, with a 17% increase.

“So a couple of them did reasonably well over, admittedly, only two or three years. They’ve mostly got a couple of years to get to the goals,” Cornish said, although some brands’ pace of progress makes their ability to achieve certain 2025 targets less certain.