- Results: Each of Silgan’s business segments experienced volume declines in Q4, CFO Kim Ulmer detailed during the Connecticut-based company’s Q4 2023 earnings call on Wednesday. Destocking in domestic food and beverage markets contributed to a 5% volume decline in Dispensing and Specialty Closures (DSC), translating to 3% lower year-over-year sales. Sales in Silgan’s largest business, Metal Containers (MC), declined 10% year over year, excluding a 2% impact from Russia sales in 2022 (Silgan said in its annual report last year it was in the process of shutting down two metal container manufacturing facilities there.) Volumes in Silgan’s smallest business, Custom Containers (CC), fell 2% and sales were down 5%.

- Market trends: CEO Adam Greenlee said that products for dispensing saw strong growth in 2023 following post-pandemic destocking, and that items for lawn and garden, hard surface cleaners, health products and sanitizers are “fully recovered.” However, sales of products for the food and beverage markets were impacted by destocking last year. Pet food was also hit by destocking initiatives midway through the year “as a result of the impact of inflation throughout the supply chain.”

- Destocking predictions: The pet food destocking issue is expected to continue in the first quarter. The company’s outlook is “a little cautious ... because as we've seen in other categories, that destocking does sort of linger on just a little bit longer,” Greenlee said. Overall, the company has seen “early signs of recovery in certain end markets for the customer destocking activities that we experienced in 2023,” positive trends expected to improve through the first half of the year, Greenlee said.

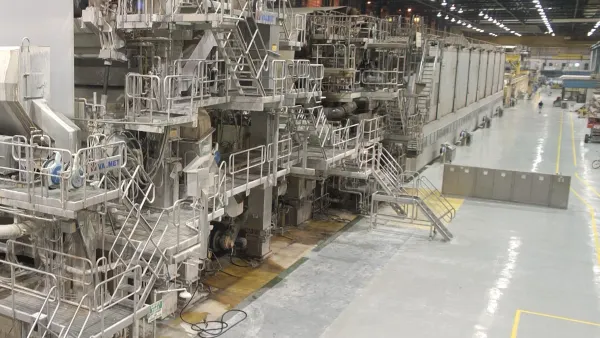

- Cutting costs: Greenlee referenced the company’s two-year, $50 million cost improvement program launched last year. The company “made several difficult decisions beginning in late 2023 and have announced the consolidation of five of our manufacturing facilities to date,” Greenlee said. However, those manufacturing changes won’t fully achieve the $50 million. Greenlee did not give specifics but said the company is “continuing to evaluate where additional opportunities to drive cost out of the system can take place,” and there will be more activity on that front in 2024. Silgan expects to have realized $20 million in savings exiting 2024.

- Growth areas: Promotional activity in the soup market and other food categories is returning. In CC, Silgan has also teased some “new wins” whose commercialization was delayed, but are expected to launch this year. High-value dispensing sales continue to perform well across geographies. And following what’s expected to be a difficult first quarter comparison in pet food, Silgan projects the business will see growth for the full year.

- Q1 outlook: The destocking trends discussed during the call are expected to contribute to low-single-digit volume declines in DSC as well as MC. Additionally, CC volumes are expected to decline by mid-to-high single digits.

- 2024 outlook: In DSC, Silgan expects volumes to grow by a mid-single-digit rate, led by high single-digit growth in dispensing products and low single-digit growth in closures. MC volumes are projected to grow by a low single-digit percentage, supported by mid-single-digit growth expected in pet food. CC volumes are expected to be more flat year over year, as growth from new business wins later in the year offsets destocking expected early in the year. Silgan expects free cash flow will be approximately $375 million in 2024 (versus about $357 million in 2023) and capital expenditures may total $240 million.

Lingering destocking trends affect Silgan sales, but CEO projects 2024 recovery

CEO Adam Greenlee also said during a Wednesday earnings call that consolidation of five manufacturing facilities, announced so far, will support its $50 million cost savings plan.

Recommended Reading

- Silgan to rightsize footprint, cut costs By Maria Rachal • Oct. 27, 2023