Sonoco is permanently closing two facilities, in Tennessee and Washington, which will affect a total of 117 workers.

The Hartsville, South Carolina-based packaging company is closing an uncoated paperboard mill in Sumner, Washington, effective immediately. It also planned to begin potentially year-long closing activities on Feb. 1 for an ends and closures facility in Memphis, Tennessee, according to a worker adjustment and retraining notification letter it sent to the state on Jan. 30.

Sonoco attributed the decision to close the Washington mill to its “ongoing strategy to optimize our mill network and lower operating costs,” according to its announcement Monday.

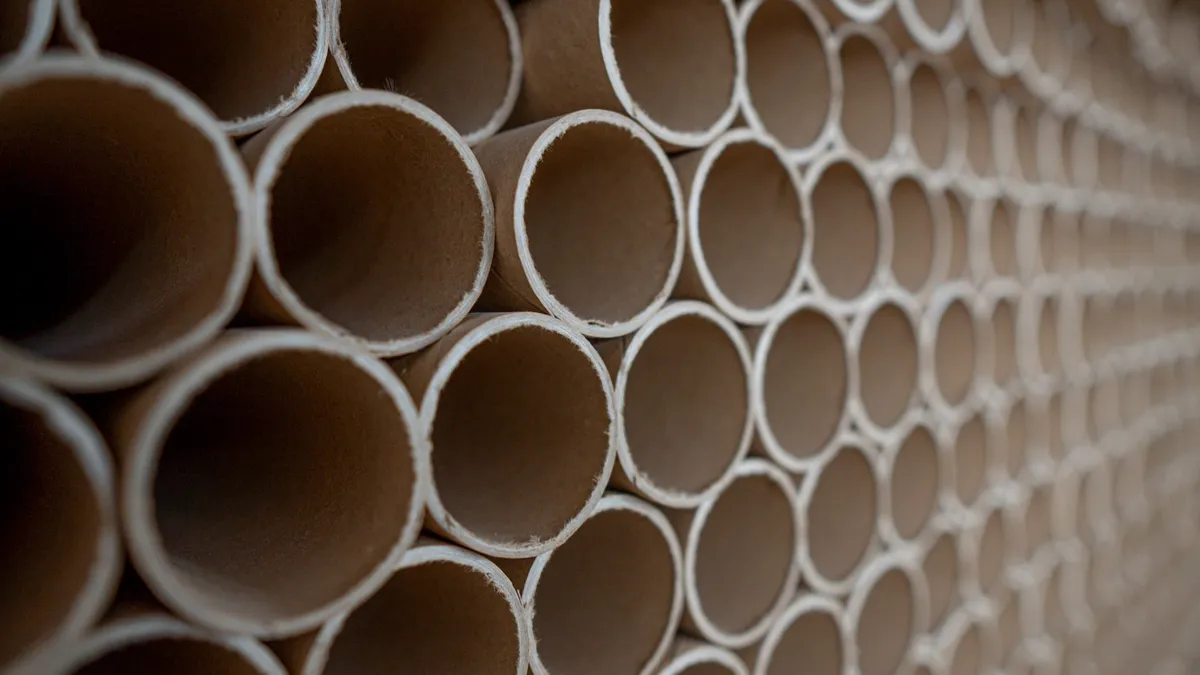

That site’s capacity is 40,000 tons annually. The company said current customers will continue to be serviced by other Sonoco mill operations. According to Sonoco’s website, Sumner was one of its 10 mills in the U.S. and Canada, and the only in the Pacific Northwest, offering a “wide range of [uncoated recycled paperboard] products, including edge protection, tube and core, tissue towel corestock,” as well as its recycled, printable EcoTect paperboard and FlatStack paperboard sheets product.

The closure of the mill — which the company reports has operated for more than a century and has been under Sonoco’s ownership since 1980 — impacts 55 employees.

“Closing facilities is never an easy decision. The mill’s team has played an important role in Sonoco’s paper operations for over forty years, and we appreciate the hard work and dedication of the entire team,” said Palace Stepps, vice president of North America paper products and fiber supply, in the Sumner announcement on Monday. “As we continue to evaluate our manufacturing footprint based on the ability to cost effectively serve our customers, we are committed to provide support to our customers and employees through this transition.” Impacted employees will be offered severance benefits.

In the Tennessee closure, the 62 workers affected in Memphis are represented by a collective bargaining agreement without bumping rights, according to the WARN letter. It says that the “Greater Memphis Local Workforce Development area will be responsible for the oversight of the continued follow-up of Rapid Response and Dislocated Worker services associated with this event.”

These closures come amid other changes to Sonoco’s portfolio and network. Last month, Sonoco announced it will divest its protective solutions packaging business, a unit with nine manufacturing facilities and 900 employees. Black Diamond Capital Management will purchase the business for an estimated $80 million in cash. Sonoco said the sale is due to its ongoing “portfolio optimization strategy.”

Last year, Sonoco site closures included a paper mill in Hutchinson, Kansas; a plant in Exeter, California; and a plastics packaging, film and sheet manufacturing plant in Fremont, Indiana.

In other areas, Sonoco grew: It acquired the remaining stake in RTS Packaging from former partner WestRock. The deal also added a WestRock paper mill in Chattanooga, Tennessee, to Sonoco’s portfolio. And on the company’s most recent earnings call, executives highlighted its $125 million initiative to transform a corrugated machine in Hartsville to a URB machine as part of Project Horizon.

Other packaging giants are also in the process of shifting their footprints in Washington. WestRock announced in January it’s closing a Seattle facility that manufactures corrugated boxes, but production will transfer to a pair of WestRock box plants in Longview, Washington, one of which newly opened in November. Aluminum beverage can maker Ball also formalized previously announced plans to shut down a manufacturing facility in Kent, Washington, with layoffs starting at the end of February.

Sonoco on Dec. 13 announced it would raise prices for all grades of uncoated recycled paperboard in the U.S. and Canada by $50 per ton, effective Feb. 1. The company said the action is “necessary to offset increased input costs.” Other fiber packaging companies have also announced price increases, though whether the market is accepting them has been a recent topic of debate.

Sonoco is expected to report fourth-quarter and full-year 2023 results on Feb. 14. Sonoco will also host an investor day on Feb. 22 in New York City.