The recent SPC Advance event in Boston, hosted by the Sustainable Packaging Coalition, included dozens of sessions about current trends. Based on those attended by Packaging Dive, these are three of the more compelling current discussions in packaging design:

Simplifying flexible packaging

Flexible packaging is growing more prevalent in the market — due to its lighter weight and ability to protect products from moisture, oxygen and light — but remains incompatible with the majority of recycling programs. Now, more companies are looking to replace the common multilayer structures with monomaterial or less complex designs.

A common theme is how paper is cropping up more often as a layer in certain flexible packaging. There are questions about paper’s barrier properties and what coatings may be required, but the material is popular.

"Paper is seen by consumers as more sustainable,” said Nathan Klettlinger, director of marketing at ProAmpac. "It's also a lot more recyclable typically in that curbside or community drop-off, you don't have to take it to the store.”

Speaking more broadly about design changes in plastic packaging, panelists said it’s a balancing act to simplify structures while maintaining quality. For example, substances as ethylene vinyl alcohol (EVOH) are useful as barrier polymers but can present potential challenges in the recycling process.

Daniel Cluskey, a product stewardship engineer at Printpack, said barrier methods that have long been used in traditional packaging may need a “rethink” in light of recyclability goals.

“We can't just put as much nylon and EVOH and metallizer films and coatings as we want,” he said. “We need to use those sparingly and make sure that we're optimizing the use of them and not overdesigning the package.”

At the same time, certain categories also require more durability.

Large pet food bags — which one speaker called “the next battleground” for changes in this area — must be designed to sustain more weight. Klettlinger said a bag that may contain 10-plus pounds of pet food, versus other products that may be measured in ounces, has a lot of potential “areas for failure” if its seals aren’t designed properly.

Overall, some panelists suggested taking an incremental approach to improving the design of flexible packaging. This could mean eliminating the foil layer, or introducing higher levels of postconsumer recycled content, before trying to make an item fully recyclable.

"PET laminates have been around for 50 years and have been optimized for that time, and so we're kind of at the beginning of this journey of how do we create monomaterial films from polyethylene and optimize them,” said Michelle Sauder, marketing director for food and specialty packaging at Dow.

Evolution of reuse

Many brands have pledged to boost the percentage of their packaging that is reusable or refillable, but that landscape is still taking shape and market penetration is relatively limited.

Olga Kachook, director of the Sustainable Packaging Coalition, challenged the audience to step up their efforts and think of reuse as the default — using the acronym RAD as shorthand.

"Instead of trying to pilot reuse as an add-on to retail, food service, e-commerce models, where most things are currently in single-use packaging, RAD flips everything on its head and asks why not make everything reusable?" she said, adding that “with pilots or an opt-in approach, you're essentially doubling your work.”

Citing examples such as service ware at Ikea’s cafeterias, tools in dental offices and shampoo dispensers in hotels, Kachook said consumers are already well-acquainted with this concept. And even if it may not be plausible for reuse and refill to take over the entire retail experience it could still be done for certain categories such as laundry products, online purchases or carryout bags, among others.

Speaking in a separate session, Lindsey Hoell, CEO of startup Dispatch Goods, said reuse systems can have a customer engagement benefit in addition to other savings for a brand.

"We generally launch because there is a cost savings and we scale because there is a churn reduction,” said Hoell, adding that it’s a prime marketing opportunity when a consumer wants to refill or reuse an item. "I think that sometimes reuse can be used to Trojan horse basically our way into other objectives and brand priorities."

Dispatch Goods has largely been focused on cost-saving opportunities in secondary packaging, such as e-commerce grocery shipments, but this engagement factor may become more important as brands consider options for primary packaging. This may not have the same level of cost savings, but retailers could see recurring sales when customers return to a store to refill primary packaging.

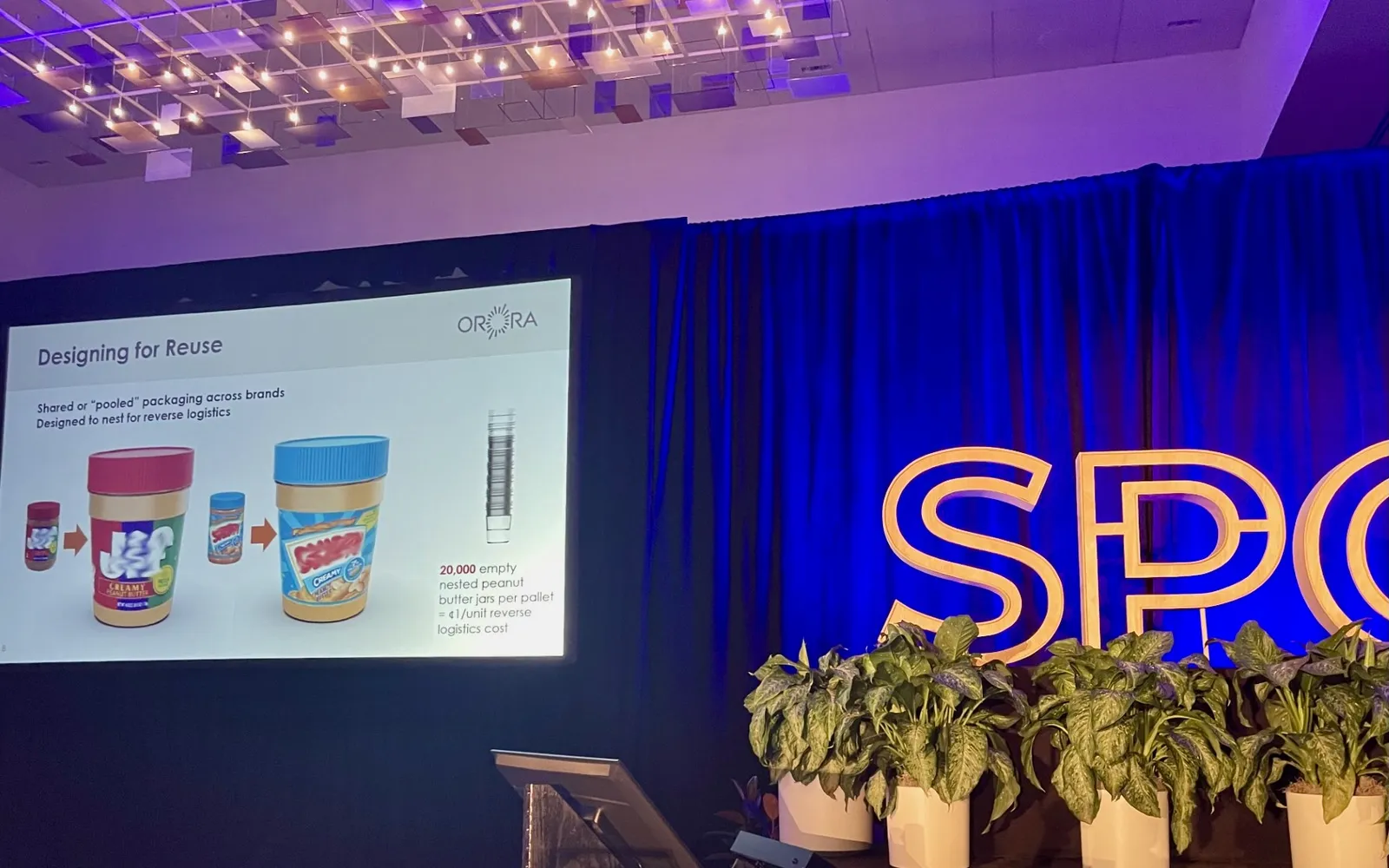

Orora Packaging Solutions also presented a design harmonization concept at SPC Advance that it hopes could reduce costs for reusable primary packaging.

"If you have a very low-velocity product,” selling handful of units per week, then reuse “will never scale,” said Chris Bradley, chief marketing and sustainable design officer for Orora, citing examples such as peanut butter.

"If we're going to actually get reuse to scale we need to fundamentally change the way we're designing consumer packaged goods,” he said.

Bradley debuted a product called Jarbot that could reduce the wide array of “bespoke” packaging currently seen across tens of thousands of individual products in the grocery store. This reusable plastic container has the base design of a cup, but could also become a jar or bottle with added components. He estimates it could take out around 10,000 SKUs from the average grocery store if adopted at scale. It also allows for nesting to enable easier and faster reverse shipping.

Bradley envisions the containers having PET shrink sleeves, which could be opaque to preserve certain products, that would be recycled after each use cycle. The sleeves would also maximize labeling space for brands and protect the packaging across multiple use cycles.

EPR implications becoming mainstream

With various packaging EPR laws moving toward implementation in four U.S. states, and more possibly on the way, many speakers had ideas about how this could change packaging.

"I think that is probably what's going to push some more of the acceptance of these more sustainable substrates in packages because then that ROI can be measured a little more clearly,” said Klettlinger of ProAmpac, noting that it can be harder for a brand or marketer to explain the costs involved with a change, whereas "EPR laws will help justify that.”

This may also be another reason to move ahead on PCR projects and related certifications, rather than waiting for the final details of each state’s system.

"Those are long qualification processes and any of that time that you spend qualifying after the EPR has already passed is going to be time that you are paying those fines,” said Cluskey of Printpack.

Speakers also believe EPR can accelerate the reusable packaging trend.

"Reusable packaging will always cost more up front, but the idea is that you're able to amortize those costs over time as you get many, many use cycles out of it,” said Andy Rose, director of sustainable circularity at Indeed Innovation, in the context of designing a product to withstand high numbers of reuse cycles. "If there is an EPR fee, that essentially bumps up ... the cost of single-use packaging and moves forward that break-even point.”

Another change expected from EPR is a greater focus on data. Michelle Carvell, chief operating officer of Lorax EPI, said the data required to calculate EPR costs is also tied to data required for sustainability reporting and other areas. "All of those things build up to your picture of sustainability,” she said.

As this data becomes more essential to ensuring compliance and making strategic decisions, it may also spotlight the importance of knowledge from packaging professionals within a given organization.

"I really believe this is going to elevate the packaging profession to the boardroom,” said Laura Foti, chief marketing officer of Specright.

Correction: This article has been updated to clarify that EVOH is a barrier polymer.