There has long been a gap between the pace of new packaging innovations and the viability of recycling those materials. Now, driven by a mix of regulatory, consumer and investor pressures, the two sectors are increasingly looking for ways to work together.

Collaboration between these industries isn’t new, but the two sectors often feel siloed. This dynamic was uniquely apparent last month, when the Sustainable Packaging Coalition and Solid Waste Association of North America held conferences in Boston during the same week. Overlap between attendees was limited, but each event featured relevant discussions for both fields.

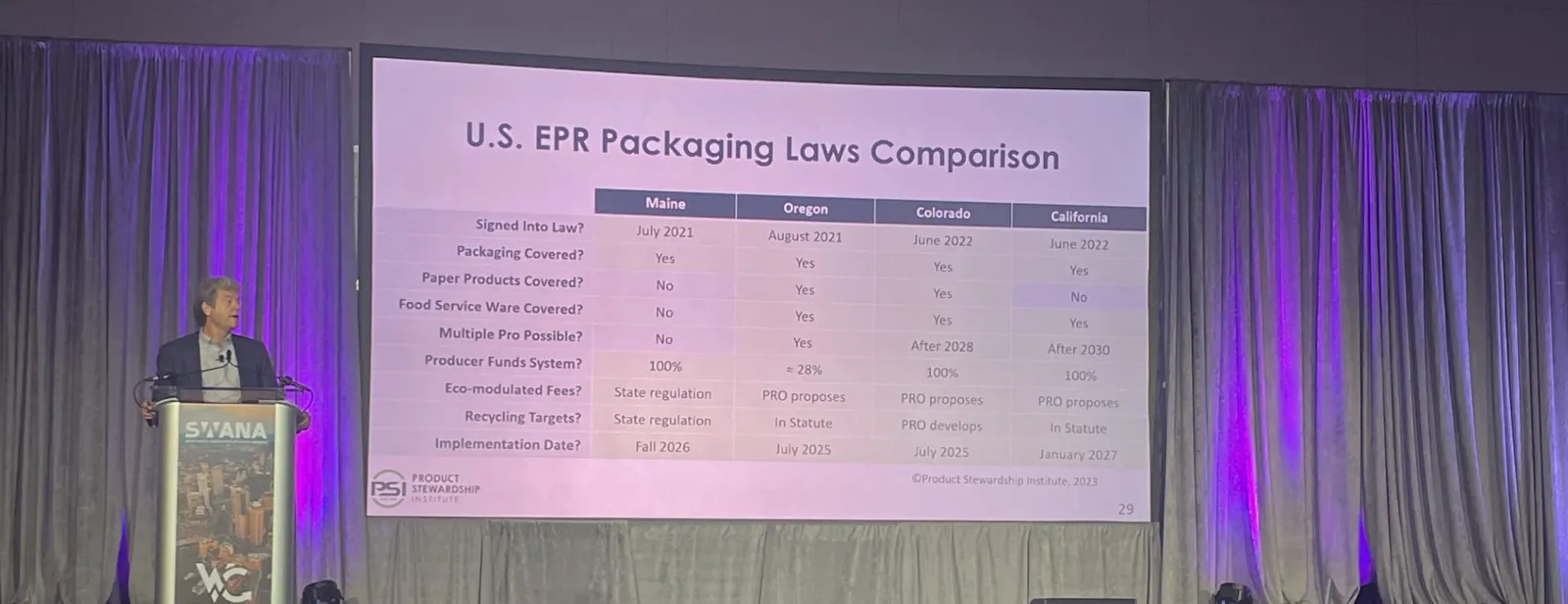

"We're in a paradigm shift for how waste is managed in the United States and globally,” said Scott Cassel, CEO of the Product Stewardship Institute, during a keynote speech at WASTECON that discussed how state extended producer responsibility laws are driving more interest in harmonizing policy and recyclability definitions. "We've been working on packaging for 15 years and it's only the past three or four years that we've gotten more of the producers coming in and more of the recyclers engaged."

In another sign of these efforts, SPC touted its strategic partnerships with recycling-focused entities such as Closed Loop Partners and the Association of Plastic Recyclers, among others. SPC Advance also featured multiple sessions about how regulatory and consumer pressures are accelerating the push for new ideas.

For example, specialty recycler Ridwell grew out of Seattle-area consumers’ desire to recycle more material and is now operating in multiple states.

"I think also fueling that is some frustration and guilt that they feel that they're awash in packaging, frankly, and they don't know what to do with it in a way that feels right,” said Gerrine Pan, Ridwell’s vice president of partnerships, at SPC Advance.

Recycling ventures

SPC Advance featured numerous discussions about efforts to make packaging more recyclable or compostable, with panels about how major recycling companies approach decisions around collection and processing infrastructure.

WM and Dow spoke about efforts to scale plastic film recycling through Natura PCR. According to Ganesh Nagarajan, senior director of plastics at WM, the two companies “now have the controlling interest” in that business following an investment last fall. Natura has since received a sign-off from the Food and Drug Administration to make food-grade packaging, and WM has pursued plans to accept plastic film in certain curbside programs.

"It's there as a contaminant in our stream whether we want it or not in the curbside [programs],” said Nagarajan. "What WM has done with these MRFs that have been selected is to make modifications that actually allow for the film not only to be received, but to be sorted, and for a bale to be created."

U.S. EPA data shows the plastic “bags, sacks and wraps” category has grown in recent decades, but most curbside programs don’t accept the material and it has a low recycling rate. WM has a goal of making curbside film recycling available to an estimated 8% of all U.S. households in the coming years. Dow has its own goal of roughly doubling the amount of “circular and renewable” feedstocks it provides by 2030.

"WM offers us a single source for potentially tapping into this large volume of material that we need,” said Adwoa Coleman, Dow’s senior sustainability manager for North America.

In a separate session, Republic Services touted its own upcoming plastics investments. The company is taking a different approach, by investing in multiple “polymer centers” for secondary processing of MRF plastics such as PET, HDPE and PP. The first site is on track to open in Las Vegas later this year.

Joe Riconosciuto, director of materials marketing and recycling, said company executives first had the idea when they traveled to visit European counterparts in 2019.

"They were surprised from the first visit to the last that everybody wanted to buy our plastics. They were caught entirely flat-footed,” he said. "We'd been collecting, aggregating, processing plastics for a long time ... but it was never viewed as being uniquely valuable — it wasn't strategic for us.”

Republic is targeting major brands, such as Coca-Cola, that want more reliable supplies of postconsumer recycled content. According to Riconosciuto, “circularity requires specificity,” so the ability to separate plastics by resin type, color or other categories is appealing.

"It allows us to engage with brand owners and their supply chains,” said Riconosciuto, "by purposefully stepping into this space and saying we care about the product — not just the process, but we care about your material that has your name on it.”

Another SPC Advance session focused on differing approaches by Casella Waste Systems and Ridwell to assess markets for different categories of plastics.

Casella recently partnered with TerraCycle for a specialty pouch collection program in Burlington, Vermont, that allows for the collection of items not typically accepted curbside. Abbie Webb, Casella’s sustainability director, said cartons have been popular in the TerraCycle pouches because "this program is filling a niche that the MRF doesn't fill” for residents in that specific area. Flexible packaging is also a common item in the program.

While Casella’s newer MRF technology has the flexibility to sort for additional streams in the future, the company has been disciplined with limiting its curbside lists to products that can be processed safely and have reliable, diverse end markets. For example, Webb noted that overhead suction systems to capture plastic film at MRFs presented an ergonomic challenge for workers, and she said other items like flexible packaging can potentially contaminate loads of more valuable commodities.

Pan said plastic film is the the most common item that Ridwell collects, followed by multilayer flexible packaging, albeit at a smaller scale than companies like Casella. Ridwell initially struggled to find a market for flexible packaging, in part because processors already have access to a cleaner stream of postindustrial misprints, but the material is now mechanically recycled into uses such as piping, cinder blocks or gravel.

In another example, Ridwell’s efforts to collect PET thermoforms in one city led the local hauler to begin accepting that material in the curbside program.

"It wasn't about creating the end market,” said Pan, “but it showed a possible path for collection.”

At the same time, Ridwell has decided certain categories, such as PET foam and silicone, don’t have viable markets. Pan also said the company tries to be mindful of the environmental effects involved with shipping small amounts of material long distances to a processor.

Market realities

Amid all of the focus on creating markets for new categories, speakers at the events also provided reminders about the limitations of current and future recycling infrastructure that can affect the ability to recover more packaging.

During a sales presentation at WASTECON, EverestLabs CEO JD Ambati said his company’s AI platform routinely identifies MRFs that are missing valuable material. One site was losing an estimated $650,000 worth of aluminum, PET and HDPE through its system. Fine-tuning allowed it to start recovering at least 70% of that. Packaging companies are starting to take notice, as seen with a program funded by Ardagh Metal Packaging and Crown Holdings that led to Everest equipment being installed at a California MRF.

As for chemical recycling, which many companies at SPC Advance touted as a key part of their future recycled content or recyclability plans, some panelists were skeptical of its viability and challenged packaging companies to rethink their priorities.

Veena Singla, a senior scientist with the Natural Resources Defense Council, portrayed these sites as perpetuating demand for fossil fuels because many of them are focused on turning plastic into fuel rather than making new feedstock.

"Whatever you think is happening to your materials, it ends up in someone's community,” said Melissa Miles, executive director of the New Jersey Environmental Justice Alliance. “We cannot continue to consume the way we do in this society.”

Another question at the heart of any effort to scale up recycling rates for certain products, which in turn can influence the market for recycled content, is consumer engagement.

"It doesn't happen overnight. We spent the last 30 years or so telling people not to put film in the bins,” said WM’s Nagarajan. He said that markets for recovered plastic film remain a work in progress and must be proven out to get municipalities to view the material in the same way as other categories such as PET. "If film programs don't realize that kind of potential then there will be a lot of naysayers, so we've got to make sure that part of the challenge is addressed,” said Nagarajan.

While some speakers believe upcoming state regulations around EPR and acceptable materials will start to resolve some of this, the rate of packaging changes may also make the gap between new products and recyclability an ongoing challenge.

“...If you go back and look at pictures of grocery stores in the ‘50s, ‘60s, there was a limited number of packaging choices,” said Casella’s Webb, noting how metal cans and glass bottles had significant market share at the time, but now the “proliferation of different types of packaging” has diluted those volumes.

Ridwell’s Pan had a similar take, saying that “at the rate at which we innovate packaging, there is always going to be something that's not on the current list of accepted materials in a given program.”

Interested in more recycling news? Sign up for the weekly Waste Dive: Recycling newsletter today.